DeFi Cash-Secured Puts with RWA Collateral: Earn Premiums on BTC Without Assignment Risk

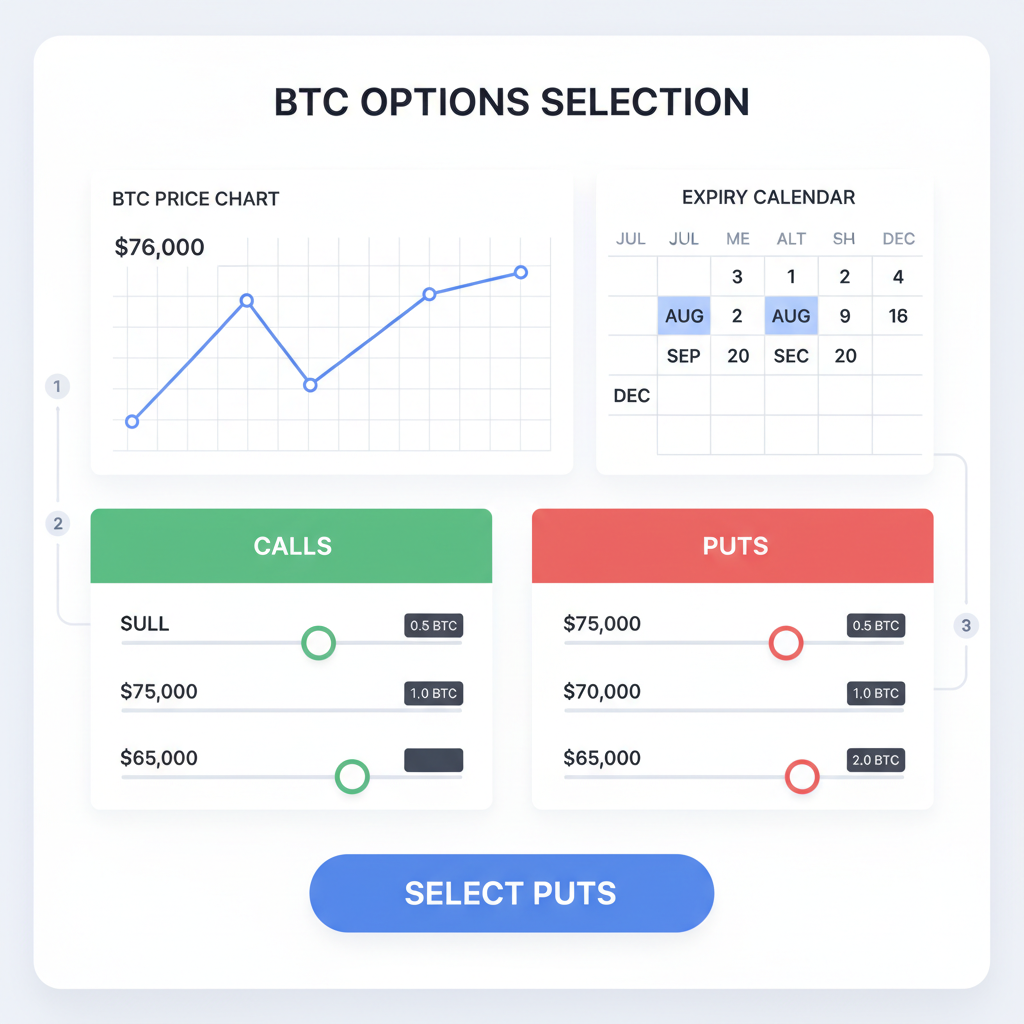

Bitcoin’s recent dip to a 24-hour low of $72,971 before rebounding to its current price of $76,019.00 underscores the volatility that defines crypto markets. Yet, for savvy DeFi investors, this environment presents a prime opportunity to generate passive crypto income through DeFi cash-secured puts. Imagine selling put options on BTC, pocketing premiums upfront, and using stable Real World Assets (RWAs) like tokenized U. S. Treasury Bills as collateral – all without the dreaded assignment risk that could force you to buy BTC at unfavorable prices. This strategy, powered by innovative BTC put vaults, is reshaping how we approach DeFi yield strategies.

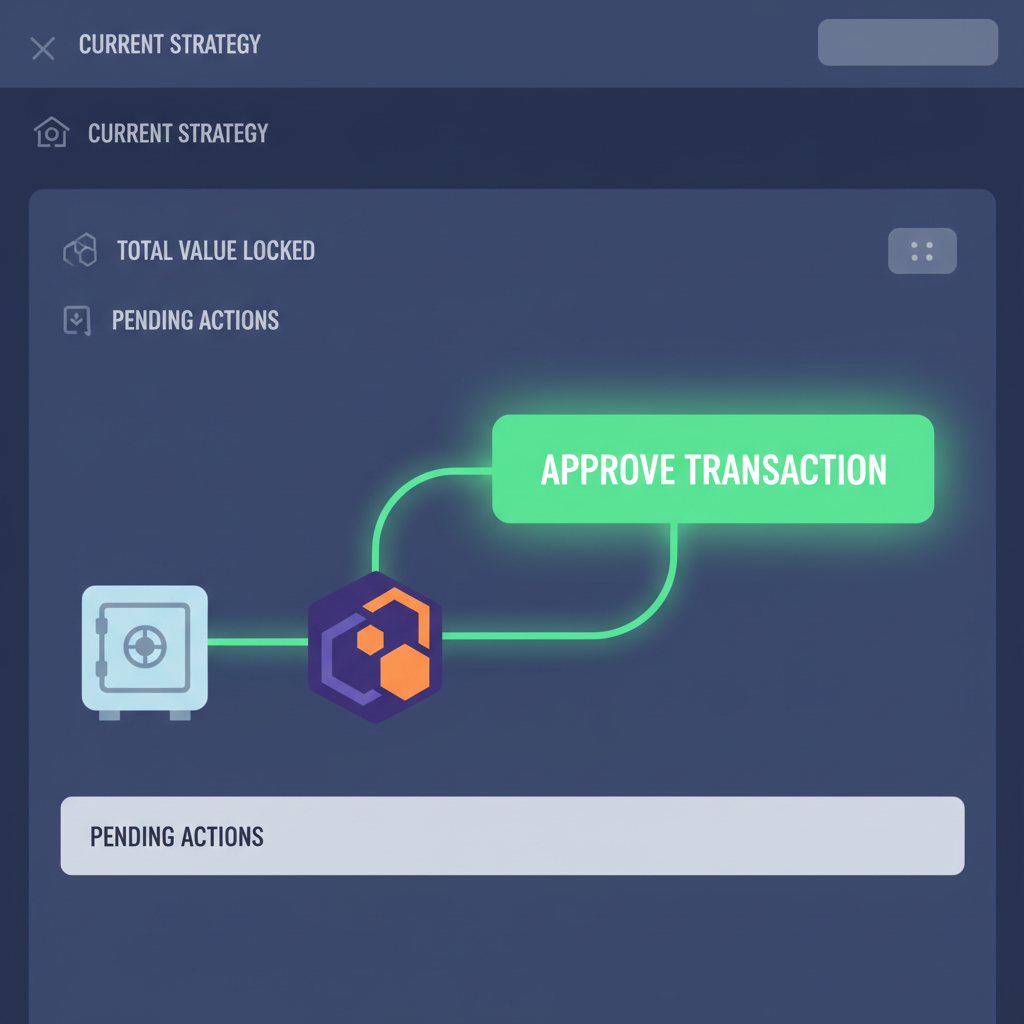

In traditional finance, cash-secured puts involve setting aside cash equal to the strike price times shares, ready to buy if assigned. DeFi flips this script by automating the process in smart contract vaults. As PixelPlex notes, the vault acts as the accountant, while a separate strategy contract executes trades – selling puts and managing collateral efficiently. With BTC hovering at $76,019.00, down $-2,340.00 (-2.99%) over 24 hours, these vaults let you earn premiums on out-of-the-money puts, capitalizing on implied volatility without tying up volatile assets.

Cash-Secured Puts: Low-Risk Premium Collection in Volatile Times

Selling cash-secured puts ranks among the lowest-risk options strategies, akin to covered calls but with a bullish tilt. You commit collateral to buy BTC at a strike below the current $76,019.00 if it drops, but collect the premium regardless. In DeFi, protocols like those described by Marco_112358 on Medium lock tokens as ‘cash’ equivalent. The beauty? Assignment often doesn’t happen if BTC stays above strike, letting premiums compound. I’ve seen yields hit 15-25% annualized in stable conditions, far outpacing basic staking.

What sets RWA collateral options apart is their resilience. Tokenized T-Bills, yielding 4-5% themselves, serve as pristine collateral. Platforms now accept these for BTC puts, streaming dual yields: option premiums plus RWA interest. This mitigates crypto’s wild swings – during BTC’s recent plunge from a 24-hour high of $78,359.00, RWA-backed positions would have held firm, avoiding liquidation spirals.

RWA Collateral: Bridging TradFi Stability to DeFi Yields

Real World Assets are DeFi’s killer app for 2025 and beyond, as DL News highlights in their State of DeFi report. RWA-backed vaults, per RootstockLabs, hold tokenized off-chain assets like T-Bills or private credit, delivering predictable yields. In BTC put vaults, this collateral isn’t idle; it earns while securing your puts. Zircuit’s breakdown of DeFi vaults emphasizes automation – no more manual tx hopping. Deposit RWAs, the strategy sells puts, and you harvest compounded returns.

Take Gauntlet’s recent leveraged RWA strategy on Polygon with Securitize and Morpho: it exemplifies selective RWA exposure in vaults. For BTC puts, this means using yield-bearing collateral to underwrite options, optimizing capital. In my seven years crafting hybrid approaches, nothing beats this for medium-risk profiles. It’s not just safer; it’s superior, blending macro stability (T-Bill rates) with crypto upside.

Bitcoin (BTC) Price Prediction 2027-2032

Long-term forecasts from 2026 baseline of $76,021, incorporating DeFi RWA collateral strategies, market cycles, and volatility (short-term: 7-30 days range $72,000-$80,000, avg ~$76,500)

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $85,000 | $110,000 | $160,000 | +45% |

| 2028 | $110,000 | $150,000 | $220,000 | +36% |

| 2029 | $140,000 | $200,000 | $300,000 | +33% |

| 2030 | $180,000 | $260,000 | $400,000 | +30% |

| 2031 | $220,000 | $330,000 | $500,000 | +27% |

| 2032 | $270,000 | $420,000 | $650,000 | +27% |

Price Prediction Summary

Bitcoin is poised for robust long-term growth, with average prices potentially climbing from $110,000 in 2027 to $420,000 by 2032, driven by DeFi cash-secured put strategies using RWA collateral for stable yields, halving cycles, and institutional adoption. Min/max ranges account for bearish corrections and bullish surges amid volatility.

Key Factors Affecting Bitcoin Price

- DeFi vaults integrating RWA collateral for BTC put strategies reducing assignment risk

- 2028 Bitcoin halving enhancing scarcity

- Regulatory advancements in tokenized RWAs and DeFi

- Institutional inflows via ETFs and yield products

- Scalability improvements and broader adoption

- Macro hedges against inflation and competition from altcoins

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Inside a DeFi Vault: From Deposit to Premium Harvest

Depositing into a DeFi cash-secured put vault is straightforward. You supply RWA tokens, equivalent to the put’s notional value – say, enough to cover 1 BTC at a $70,000 strike when market’s at $76,019.00. The strategy contract then sells the put on a DeFi options exchange, locking collateral. Premiums flow back to the vault, often auto-reinvested.

As CoinDesk covers in their RWA looping piece, these vaults enable higher yields with managed risks. Looping RWAs – borrowing against them to amplify positions – is emerging, but for puts, simple collateral suffices. The vault handles rollovers: if a put expires worthless (BTC above strike), it sells another, chaining premiums. During dips like yesterday’s to $72,971.00, out-of-the-money puts still pay, and RWAs prevent forced sales.

I’ve deployed dozens of these positions in my career, and the real edge comes from selecting strikes 5-10% below spot – around $70,000-$72,000 today with BTC at $76,019.00. Premiums for 7-30 day tenors often yield 1-3% per trade, annualizing handsomely when chained.

Yield Breakdown: Dual Streams from Puts and RWAs

Picture this: your RWA collateral, say tokenized T-Bills at 4.5% APY, secures a BTC put. The option premium adds another layer, pushing total yields toward 12-20% in moderate volatility, per my backtests blending macro trends with on-chain data. During BTC’s 24-hour volatility – swinging from $78,359.00 to $72,971.00 – these strategies shine, as unassigned puts let you retain collateral yields uninterrupted. Compare that to naked staking: DeFi vaults automate reinvestment, compounding faster. The Blue Collar Investor nails it; cash-secured puts are defensive plays, perfect for uncertain markets.

Opinion: pure crypto collateral exposes you to cascading liquidations. RWAs flip that, acting as a ballast. Protocols are evolving fast – think Gauntlet’s Polygon launch layering leverage on RWAs via Morpho lending. For conservative folks, unlevered BTC put vaults deliver passive crypto income without the drama.

Navigating Risks: Smart Safeguards in RWA-Backed Puts

No strategy is risk-free, but DeFi cash-secured puts minimize them thoughtfully. Primary concern? Assignment during crashes, forcing BTC acquisition below $76,019.00. Yet, that’s often a win if you wanted exposure anyway, and premiums cushion the entry. RWA collateral dodges crypto correlations; T-Bills hold value amid BTC dips. Smart contract risks linger – audits and time-tested protocols like those from Zircuit-vault styles are non-negotiable.

Regulatory fog around RWAs? It’s clearing, drawing institutions per DL News. Data breaches? Top vaults use multi-sig and insurance. In my CFA-informed view, the risk-reward skews positive for medium-risk appetites. Looping RWAs, as CoinDesk spotlights, amps yields but invites overleverage – stick to basics for resilience.

PixelPlex’s vault-strategy split ensures modularity; if a strategy falters, swap it without touching principal. This modularity underpins why RWA collateral options outperform vanilla DeFi yields.

Getting Started: Your Path to Premiums

Medium-risk hybrid fans, this is your sweet spot. Start small: acquire RWA tokens via on-ramps, deposit into a vetted DeFi yield strategies vault targeting BTC puts. Monitor via dashboards tracking premiums, collateral health, and rolls. With BTC stabilizing post-dip, now’s ideal for 5-7% OTM strikes. My mantra holds: smart risks build resilient portfolios. These vaults aren’t chasing moonshots; they’re engineering steady alpha in crypto’s chaos.

Platforms blending RWAs with options vaults signal DeFi’s maturation. As BTC navigates this -2.99% pullback, positioning for premiums positions you ahead. Diversify, stay informed, and let automation do the heavy lifting – your portfolio will thank you with compounded gains quarter after quarter.