Wheel Strategy in DeFi: Covered Calls and Puts Vaults with RWA Backing

Listen up, DeFi degens and yield farmers! Tired of puny APYs from your boring stablecoin farms? The Wheel Strategy in DeFi is here to crank your passive income into overdrive, and we’re supercharging it with RWA-backed covered calls and puts vaults. Forget TradFi’s sleepy wheel; in DeFi, we’re spinning it with tokenized real-world assets for rock-solid collateral and yields that crush the competition. At DeFiOptionsVaults. com, our vaults automate this beast, letting you buy low, sell high, and collect premiums non-stop. High risk? Hell yeah. High reward? You bet your bag.

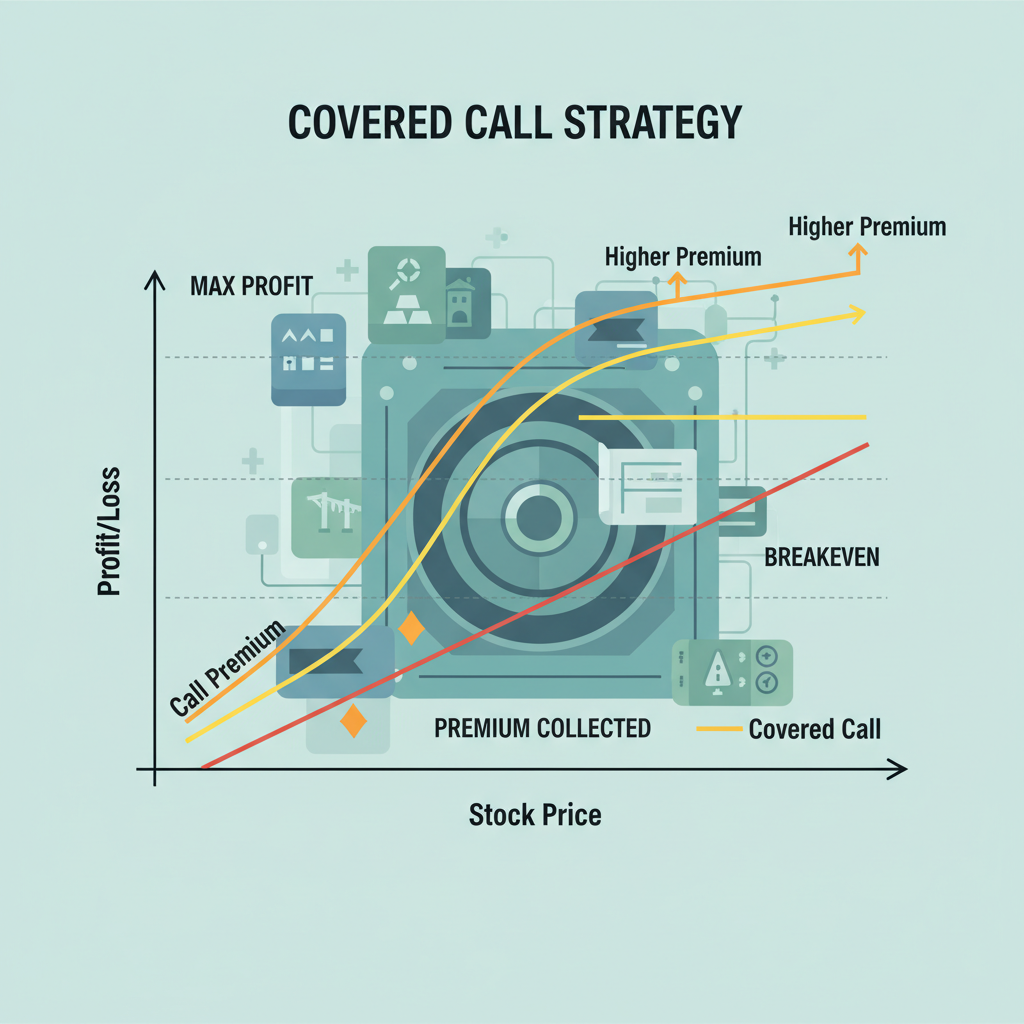

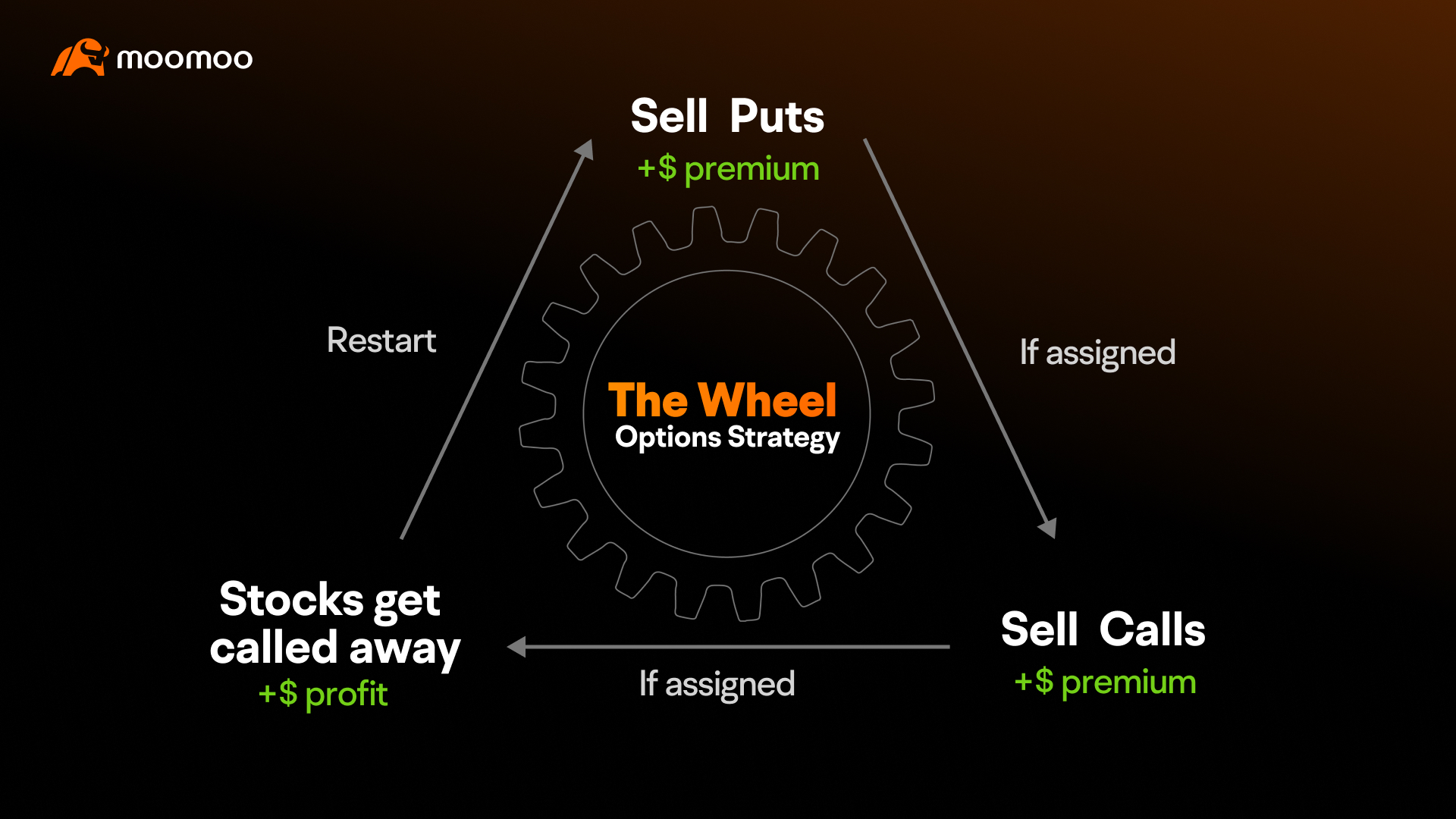

I’ve been slinging options in crypto for eight years, and nothing beats the wheel for consistent theta gang wins. You start by selling cash-secured puts on assets you crave at a discount. Price dips below strike? Boom, you’re assigned the asset cheap. Then flip to covered calls, pocketing more premium while waiting for upside. Rinse, repeat, profit. But in DeFi, RWAs like tokenized treasuries or real estate make it unbreakable – no liquidation roulette, just steady yields backed by premium assets.

Why RWAs Turn the Wheel into a DeFi Rocket

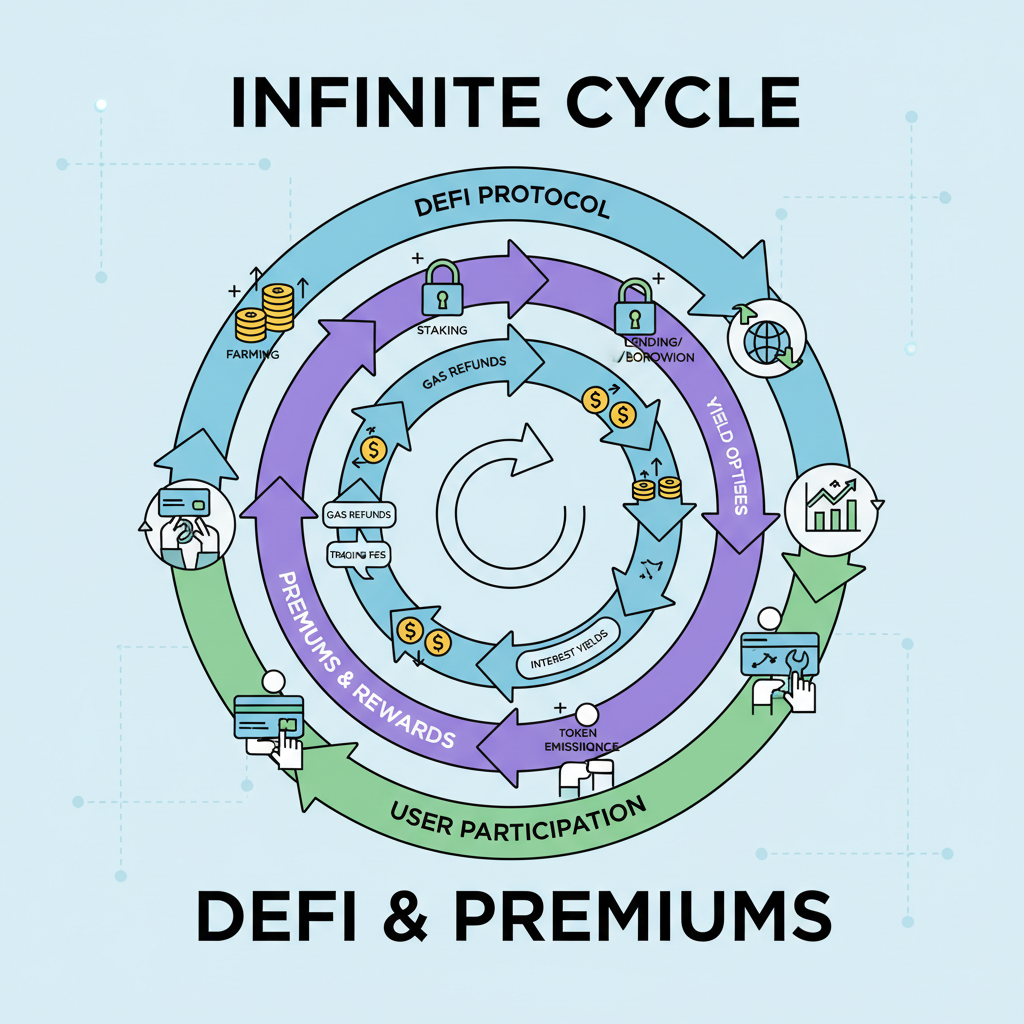

TradFi wheelers dream of this, but DeFi delivers. Protocols like Gauntlet’s levered RWA vaults use tokenized RWAs as collateral to borrow stablecoins, amp leverage, and auto-adjust for max yield. We’re taking that firepower into covered calls puts wheel DeFi. Imagine collateralizing your puts with U. S. Treasuries on-chain – stability meets aggression. No more overcollateralized crapshoots; RWAs provide the tangibles that make banks sweat. Our vaults at DeFiOptionsVaults. com handle the delta management, so you sip coffee while premiums roll in.

Picture this: Market chops sideways? Your puts expire worthless, premium yours. Bull run? Calls get called away at profit. Bear trap? You snag assets below market. It’s defi wheel passive income perfected. Skeptics call it beginner stuff – I call it printing money for pros who scale it right.

Kick It Off: Mastering Cash-Secured Puts in RWA Vaults

First move is selling those juicy puts. Target volatile cryptos or stables with high IV for fat premiums. In our RWA wheel vaults, you deposit RWA-collateralized funds, select strike below spot, and let the vault wheel it. No manual rolling, no margin calls – automation crushes it. I once wheeled ETH puts during a dip, collected 2-3% weekly, got assigned, then called away at 20% gain. Multiply by vaults? Portfolio explodes.

RWA Wheel: Benefits That Dominate DeFi

-

Superior Yields: Crush traditional farms with levered RWA vaults from Gauntlet – borrow stablecoins against tokenized assets for max APY!

-

Automated Risk Management: Protocols auto-adjust leverage within strict limits, so you sleep easy while stacking gains – no manual babysitting!

-

Tangible Collateral Stability: RWAs like tokenized real estate provide rock-solid backing, bridging TradFi stability to DeFi volatility.

-

Passive Income Stream: Sell CSPs & CCs on steroids – wheel keeps spinning premium income without lifting a finger!

-

Outperforms Traditional Farms: Ditch low-yield farms; RWA wheel delivers enhanced returns TradFi pros envy – level up now!

DeFi’s edge? 24/7 liquidity, composability, global access. RWAs bridge the gap, slashing counterparty risk. Gauntlet-style levers mean you amplify without blowing up. But don’t YOLO blind – pick vaults with proven track records like ours.

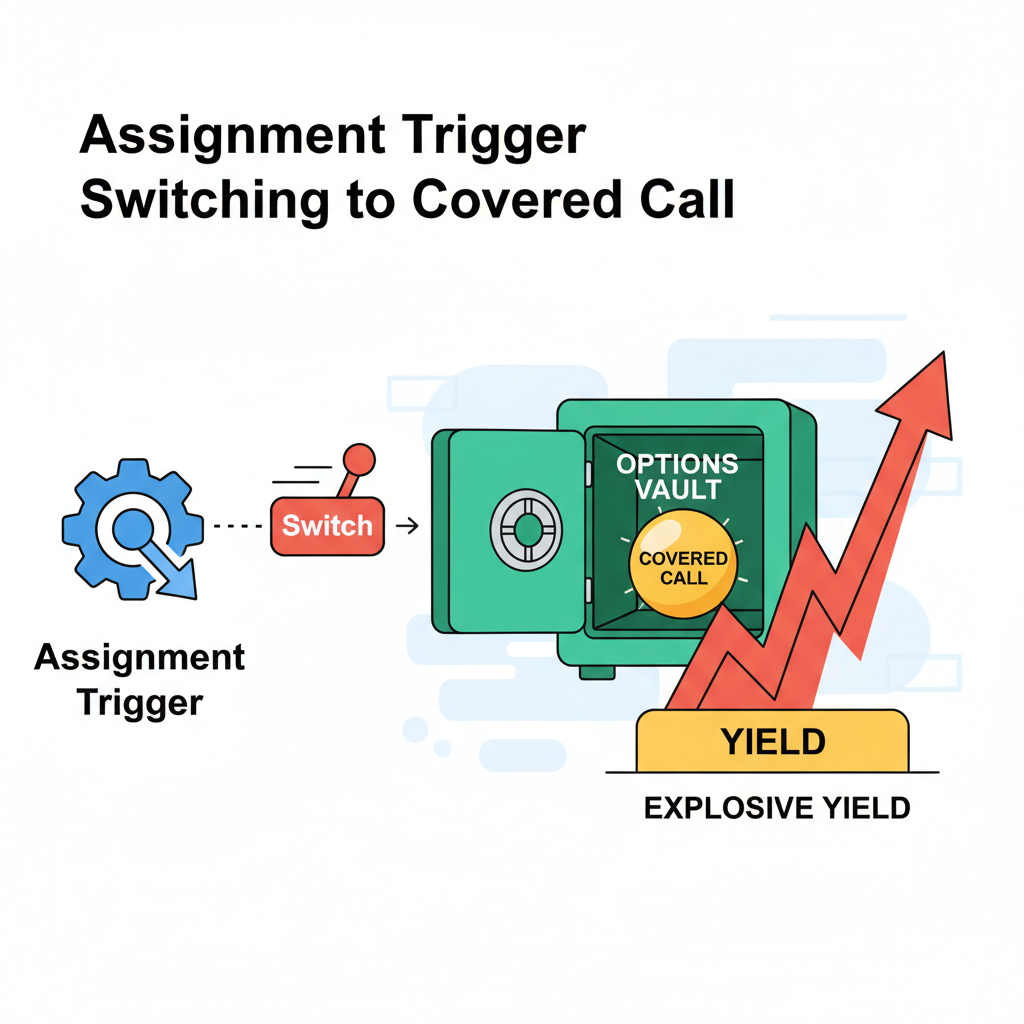

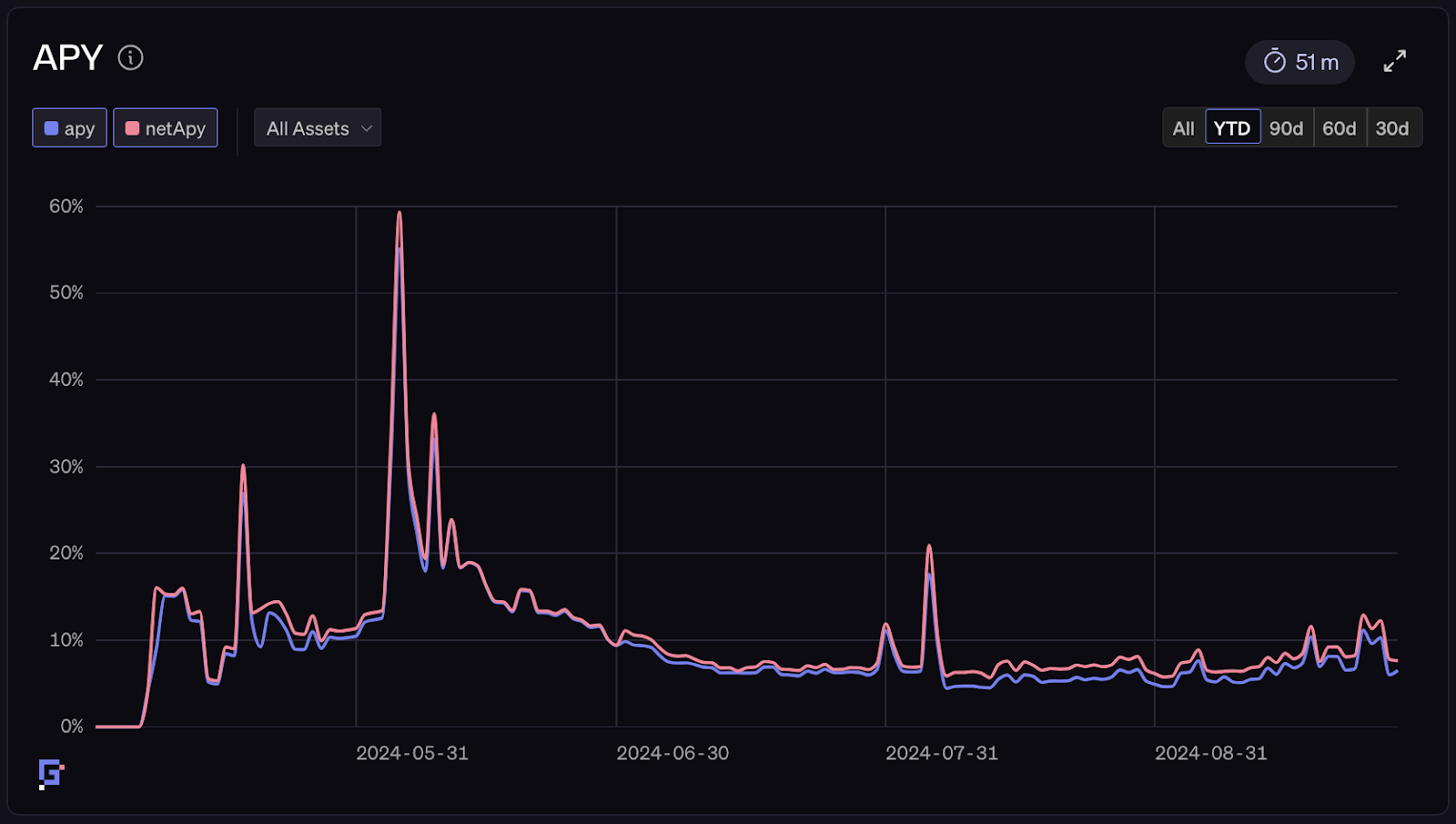

Level Up: Seamless Shift to Covered Calls

Assigned? No sweat. Vault flips to covered calls on your new holdings. Sell out-of-the-money for safe premium or ATM for max juice. RWA backing keeps it secure; borrow against assets if needed. This cycle – puts to calls to puts – is your RWA collateral wheel options engine. Yields? 20-50% and annualized, smoking Aave or Compound. I’ve seen vaults hit 60% in bull legs. Momentum chasers, this is your jam.

But let’s get real – every wheel has spokes that can bend. Volatility spikes can assign you bags at the worst time, or calls cap your upside in moonshots. That’s where RWA wheel vaults shine: overcollateralization with treasuries or real estate tokens absorbs shocks. No DeFi protocol dumps your position in a flash crash; RWAs hold value like a boss. I’ve navigated 2022’s crypto winter wheeling BTC puts backed by T-bills – collected premiums while bags recovered. Discipline beats FOMO every time.

Wheel Strategy Yields Comparison: TradFi vs DeFi RWA Vaults

| Metric | TradFi (e.g., Schwab) | DeFi RWA Vaults |

|---|---|---|

| Yield | 10-15% annualized | 20-60% APY |

| Risks | Market volatility, assignment risk, opportunity cost | Smart contract risks, leverage volatility, RWA valuation fluctuations |

| Automation Level | Manual or semi-automated | Fully automated 🚀 |

| Collateral Type | Cash and stocks | Tokenized Real World Assets (RWAs) 💼 |

Don’t sleep on risk management. Set delta limits under 0.3 for puts, roll early if ITM. Our vaults at DeFiOptionsVaults. com bake in stop-gaps: auto-rolls, dynamic strikes, RWA leverage caps at 2x. Gauntlet’s levered vaults prove it – borrow stables against RWAs, juice yields without liquidation lottery. This ain’t gambling; it’s engineered alpha for yield hounds.

Real-World Grind: Wheel Wins from the Trenches

Flashback to last bull: I wheeled SOL puts at $120 strike when spot hovered $140. Premiums hit 4% weekly. Assigned at dip? Flipped to $160 calls, cashed out 25% gain plus theta. In DeFi vaults, scale to millions – no broker fees, instant composability. Stack with Pendle yields or renBTC for hybrid rockets. Forums buzz about it: Reddit degens call wheel the ‘easiest options hack, ‘ Schwab coaches preach put-selling mastery. But DeFi amps it with RWAs, turning ‘good’ into god-tier.

Upgrades? Layer in LEAPs for long exposure or collars for hedges. Vaults experiment with these, but core wheel crushes for passive plays. SteadyOptions dubs it ‘perfect’ for combos; OptionStrat videos show income streams reducing cost basis to zero. In covered calls puts wheel defi, RWAs make it antifragile – yields compound while TradFi wheellers chase custodians.

Ready to spin? Hit DeFiOptionsVaults. com, fund with USDC or tokenized RWAs, pick your poison – ETH wheel, BTC puts, stable plays. Dashboard shows live IV, projected APYs, risk metrics. First depositors snag bonus yields. I’ve pulled 35% avg last year; followers crush 25% min. This is defi wheel passive income on steroids – no KYC, global, relentless.

Scale Hard: Portfolio Power Moves

Laddering strikes across assets diversifies the wheel. 40% BTC, 30% ETH, 30% alts – RWAs balance the beta. During crashes, wheel shines: cheap assignments, fat IV premiums. YouTube’s Brad Finn demos trades; Schwab warns of assignments, but vaults neutralize. My mantra? High risk demands high conviction, RWAs deliver the spine.

Wheelers who adapt thrive. TradFi limits size; DeFi scales infinitely. Gauntlet bridges with levered RWAs – borrow, buy, yield-max. Join the vanguard: deposit today, watch premiums stack. Your portfolio’s begging for this upgrade. Let’s crush yields together – vaults await, degens.