RWA Collateral Covered Calls Vaults: Earn 8-15% Yields on Tokenized Private Credit in DeFi

Picture this: you’re parking your capital in DeFi, chasing yields that actually move the needle, not the measly 2-6% from stablecoin lending protocols. Enter RWA collateral covered calls vaults, where tokenized private credit delivers 8-15% APY, backed by real-world assets like private credit instruments. These aren’t hype-driven plays; they’re tactical setups blending options strategies with premium collateral for steady, superior returns in a maturing 2026 market.

Comparison of Top RWA Collateral Covered Calls Vaults (8-15% Yields)

| Platform/Vault | APY Range | TVL/Tokenized AUM | Key Collateral/Notes |

|---|---|---|---|

| Gauntlet Levered RWA Vaults | 12-15% | N/A (Emerging) | Tokenized private credit; auto-leverage for enhanced yields |

| Apollo ACRED (Securitize) | 8-12% | $70M tokenized ($1B AUM) | Institutional private credit fund |

| Maple Finance | 8-12% | Part of $6B YTD growth | Tokenized private credit pools |

| Figure Technologies | 8-12% | Part of $15.9B market | Private credit tokenization platform |

| Tradable | 8-12% | Part of $15.9B market | Private credit instruments |

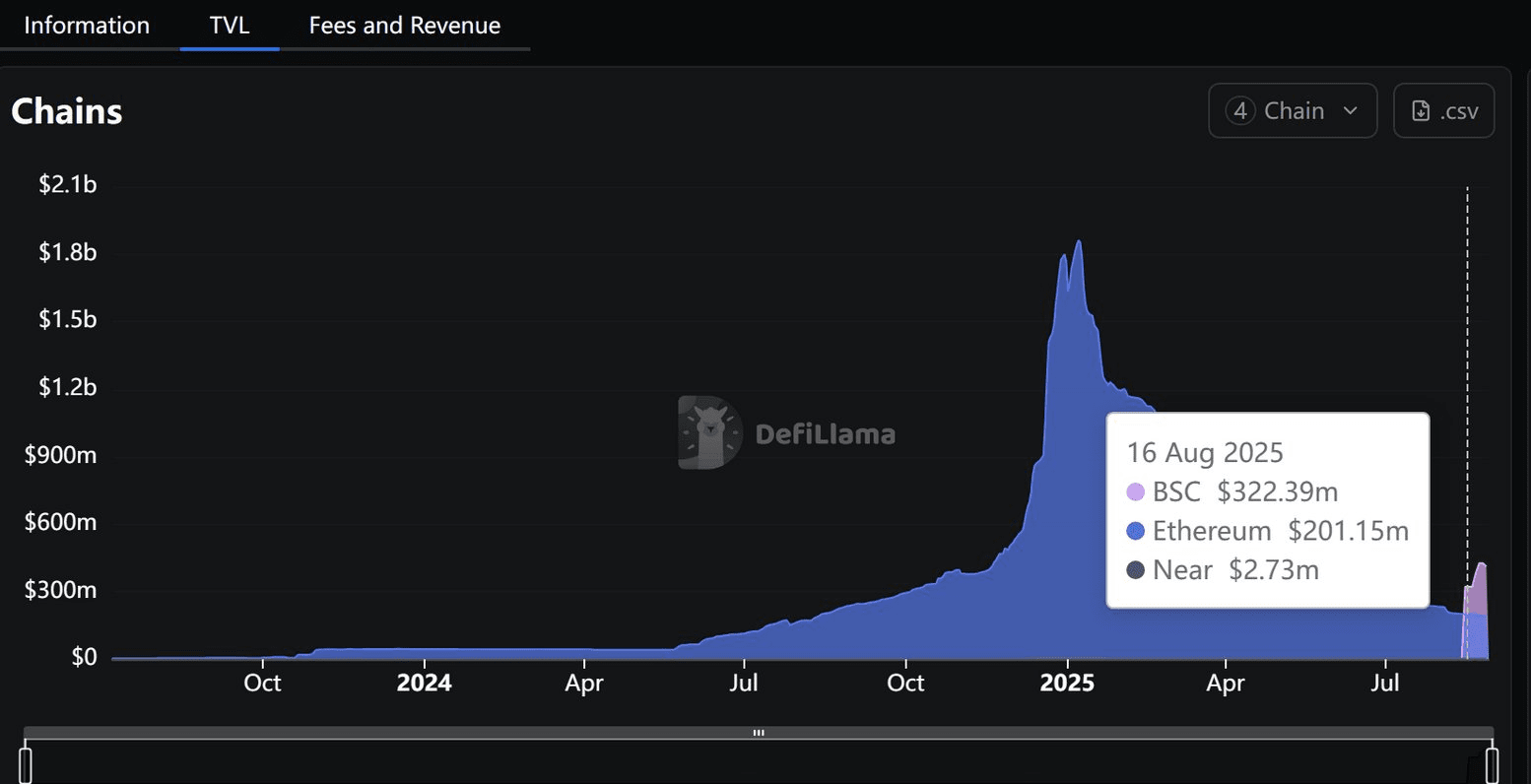

The tokenized private credit market hit $15.9 billion by September 2025, up $6 billion year-to-date, thanks to powerhouses like Figure Technologies, Tradable, and Maple Finance. Yields clock in at 8-12%, smashing the 4-5% from Treasuries and dwarfing traditional DeFi’s volatility. As institutions pile in, Apollo’s ACRED fund tokenized $70 million via Securitize, these assets bridge TradFi stability with DeFi’s automation.

Why Tokenized Private Credit Fuels Your DeFi Options Vaults RWAs

Private credit isn’t just numbers on a screen; it’s loans to vetted borrowers, tokenized on-chain for liquidity and yield. Platforms tokenize these, offering tokenized private credit yields that hold firm amid crypto swings. Compare that to vanilla DeFi: stablecoin farms flicker, but RWAs deliver because they’re collateralized by tangible debt instruments with predictable cash flows.

Yield Comparison: Tokenized Private Credit vs. Alternatives

| Asset | Yield Range | Risk Level | Why Choose It |

|---|---|---|---|

| Tokenized Private Credit 💼 | 8-12% | Medium | Superior yields from real-world credit, tokenized for DeFi vaults with covered calls boosting to 8-15% |

| U.S. Treasuries 🏦 | 4-5% | Low | Government-backed safety, but lower returns in low-rate environment |

| Traditional DeFi Stablecoin Lending 🔄 | 2-6% | High | Volatile yields, smart contract risks, no RWA backing |

| Tokenized Treasuries 📈 | 7% | Low-Medium | On-chain access to treasuries with recent TVL surge, bridging TradFi yields to DeFi |

Institutional waves are crashing in, with tokenized RWAs hitting $30 billion overall, private credit at $17 billion. Ondo’s USDY and Circle’s USYC lead tokenized Treasuries, but private credit steals the show for higher returns. U. S. senators even dropped 130 and amendments on stablecoin yields and DeFi, signaling regulatory green lights ahead.

Ondo Finance Technical Analysis Chart

Analysis by Market Analyst | Symbol: BINANCE:ONDOUSDT | Interval: 1D | Drawings: 5

Technical Analysis Summary

To illustrate the technical analysis on this ONDOUSDT chart: 1. Draw a prominent downtrend line connecting the swing high on 2026-01-05 at approximately 0.92 and the recent swing low on 2026-02-09 at 0.62, extending it forward to project continuation. 2. Add horizontal lines for key support at 0.60 (strong) and 0.65 (moderate), and resistance at 0.75 (moderate) and 0.85 (weak). 3. Apply Fibonacci retracement from the 2026-01 high of 0.92 to the 2026-02 low of 0.60, highlighting 38.2% at ~0.72 and 50% at ~0.76 as potential reversal zones. 4. Mark a downward arrow at the breakdown point around 2026-01-20 where price broke below 0.85 on high volume. 5. Use callouts to label volume spike during the January decline as ‘distribution climax’ and MACD bearish crossover in late January. 6. Rectangle the recent consolidation range from 2026-02-01 (0.70 high) to 2026-02-10 (0.62 low). 7. Add text notes for entry zone at 0.62-0.64 with ‘Potential bounce amid RWA yield strength’.

Risk Assessment: medium

Analysis: Clear downtrend with oversold signals and strong RWA macro tailwinds create balanced risk; volatility high but fundamentals mitigate crash risk

Market Analyst’s Recommendation: Hold cash or small long on support confirmation; avoid aggressive shorts given yield-driven recovery potential

Key Support & Resistance Levels

📈 Support Levels:

-

$0.6 – Strong multi-touch low from recent wicks, aligns with 0.618 Fib extension

strong -

$0.65 – Moderate intraday support holding recent bounces

moderate

📉 Resistance Levels:

-

$0.75 – Moderate resistance from early February highs and 38.2% Fib retracement

moderate -

$0.85 – Weak prior breakdown level from mid-January

weak

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$0.62 – Bounce potential from strong support amid low volume exhaustion and RWA bullish context

medium risk -

$0.72 – Short entry on failed retracement to Fib 38.2% if downtrend resumes

medium risk

🚪 Exit Zones:

-

$0.75 – Profit target at moderate resistance/Fib level

💰 profit target -

$0.58 – Stop loss below strong support to limit downside

🛡️ stop loss -

$0.68 – Short profit at recent support breakdown

💰 profit target -

$0.76 – Short stop above key Fib resistance

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: climactic spike on decline

High volume during January breakdown followed by decreasing volume on pullbacks, signaling potential exhaustion

📈 MACD Analysis:

Signal: bearish crossover and below zero line

MACD histogram contracting negatively, watch for divergence as price nears lows

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Market Analyst is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

This setup crushes passive strategies. Swing traders like me time entries on momentum signals, deploy when private credit spreads widen, exit on peaks. Risks? Credit defaults loom, so vaults mitigate with overcollateralization and oracles. Repayment hiccups? Diversified pools spread it thin. DYOR, but the math stacks up.

5 Key RWA Vault Benefits

-

8-15% Yields crush DeFi norms (2-6% stablecoin lending), powered by tokenized private credit like Maple Finance.

-

RWA Stability slashes volatility vs. crypto assets, using real-world collateral like private credit.

-

Automated Covered Calls deliver hands-off passive income—no trading required.

-

Institutional-Grade Collateral from Apollo ACRED & Securitize ensures top-tier quality.

-

Leverage Boosts via Gauntlet vaults amp returns tactically within risk limits.

Swing Trading Passive Income RWA Vaults: Medium-Risk Momentum Plays

As a 7-year swing vet, I thrive on these medium-risk vaults. Enter on dips in tokenized private credit prices, ride the yield accrual, sell calls during consolidation. Technicals matter: watch RSI for oversold bounces, MACD crossovers for momentum. Vaults like these auto-manage positions, freeing you to stack wins. Bankless Ventures eyes tokenization for 2026; John Zettler calls it DeFi vaults’ breakout year. Position now, harvest later.

TermMax’s fixed-rate stock token borrowing adds layers, rollovers for long holds or early exits. RWA market value climbs weekly, per Binance reports. These vaults aren’t set-it-forget-it; they’re rhythmic swings syncing with on-chain credit flows for optimized returns.

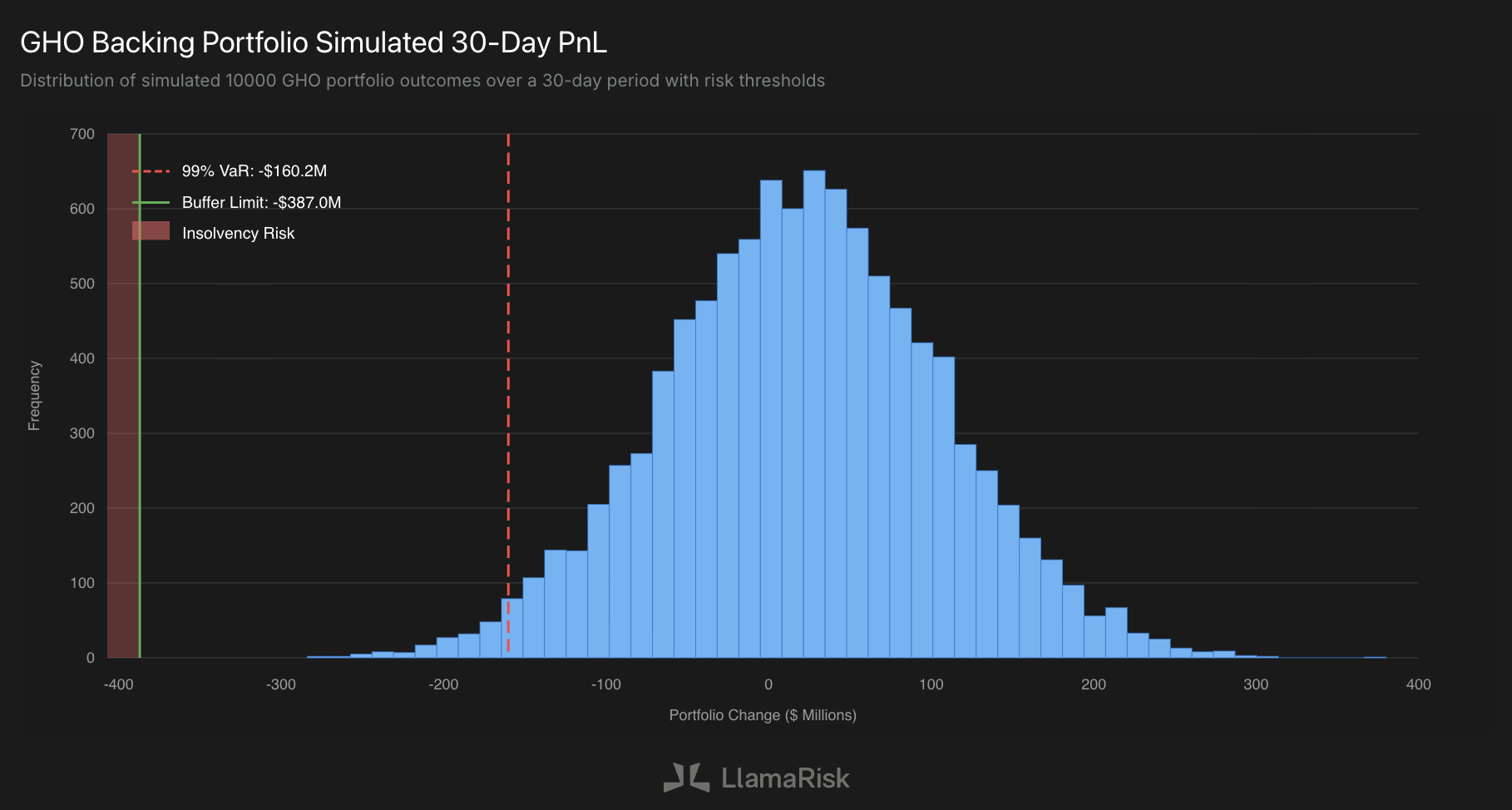

Let’s break it down tactically: deposit your stablecoins or RWA tokens into a DeFi options vaults RWAs platform, where smart contracts collateralize them with tokenized private credit. The vault then sells covered calls against that backing, pocketing premiums while the underlying yield accrues. Sideways markets? Premiums stack. Bull runs? Calls get exercised, but you keep the yield plus any appreciation up to strike. Dips? Collateral holds firm, unlike naked DeFi plays.

Tactical Edges in Covered Calls Tokenized Treasuries and Private Credit

Don’t sleep on blending private credit with tokenized Treasuries for hybrid vaults. While private credit pumps 8-12%, Treasuries add ballast, as seen in that 7% TVL jump for Ondo’s USDY and Circle’s USYC. Covered calls here cap upside but supercharge income, turning 8% base yields into 12-15% with leverage bands. Gauntlet’s levered RWA vaults automate this, borrowing stables against collateral to buy more, dialing leverage down on volatility spikes. I’ve swung these for months, entering at RSI under 30, scaling out on MACD bearish divergences. Pure rhythm.

Yield Comparison: RWA Covered Calls vs. Alternatives

| Protocol Type | Base Yield | Covered Call Boost | Total APY Range | Risk Level |

|---|---|---|---|---|

| Tokenized Private Credit | 8-12% | 3-5% | 11-15% | Med |

| Tokenized Treasuries | 4-5% | 4-8% | 8-13% | Low |

| Trad DeFi Lending | 2-6% | N/A | 2-6% | High Vol |

Risks demand respect. Private credit carries default shadows, but vaults enforce 150-200% overcollateralization, oracle feeds for real-time valuations. Regulatory flux? U. S. senators’ 130 and amendments hint at clarity, not crackdowns. Liquidity crunches? On-chain secondary markets via TermMax fix that. My rule: never exceed 10% portfolio per vault, diversify across issuers like Figure and Maple. This isn’t gambling; it’s engineered yield with guardrails.

2026 Outlook: RWA Vaults Dominate DeFi

John Zettler nails it: 2026 is DeFi vaults’ year, infrastructure primed for explosion. Bankless Ventures bets big on tokenization, institutional waves swelling RWAs to $30 billion. Private credit tokenized at $17 billion leads, yields hard to ignore per RWA. io. Swing with momentum: watch on-chain credit issuance spikes, senator bill progress, TVL inflows. These vaults outperform by merging TradFi ballast with options firepower, perfect for yield farmers tired of APY roulette.

Scale tactically. Start small, monitor vault health dashboards for leverage ratios under 2x. Pair with passive income RWA vaults for baseline stability, layer covered calls for alpha. As tokenized assets converge TradFi and DeFi, early movers lock premium positioning. Swing the vault’s rhythm, capture that 8-15% edge, and watch your portfolio compound through 2026’s boom.