RWA Collateralized Covered Calls: High-Yield DeFi Vault Strategies for Passive Income

In the evolving landscape of decentralized finance, RWA collateralized covered calls stand out as a prudent approach for yield-seeking investors navigating crypto’s inherent volatility. With Ethereum trading at $1,943.48, up a modest $1.66 or 0.000850% over the past 24 hours, the appeal of strategies blending tokenized real-world assets like treasuries and private credit with options vaults grows stronger. These DeFi options vaults RWAs offer passive income through covered calls backed by stable collateral, potentially delivering 8-15% yields without the wild swings of pure crypto exposure.

Covered calls on RWAs work by holding an underlying asset, such as tokenized treasuries, and selling call options against it. The premiums from those options generate income, while the RWA collateral provides a buffer against downside risk. This setup appeals to conservative players; after all, as a CFA charterholder with roots in traditional finance, I’ve long preached that true sustainability in DeFi hinges on layering stability atop speculation.

Mechanics of RWA-Backed Covered Calls in DeFi Vaults

At its core, a covered call strategy involves owning the asset you’re optioning. In traditional markets, you’d buy shares and sell calls; here, DeFi vaults automate it with RWAs as the backbone. Deposit USDC or stablecoins into a vault like those from DeFiOptionsVaults, and smart contracts deploy your capital into tokenized private credit or T-bills. These RWAs then collateralize short call positions on correlated assets, capturing premiums weekly or monthly.

Consider the risk layers: smart contract audits mitigate code exploits, while redemption mechanisms ensure RWA backing remains liquid. Composability shines too; these vaults integrate with lending protocols for extra yield. Yet caution prevails; oracle failures or collateral depegging could amplify losses, underscoring why bankruptcy-remote SPVs and safer oracles top my list of vetted models.

Yields Comparison: DeFi Strategies

| Strategy | APY Range | Risk Level |

|---|---|---|

| Traditional DeFi | 5-10% | 🟢 Low |

| RWA Covered Calls | 8-15% | 🟡 Medium |

| Levered RWAs | 15-25% | 🔴 High |

Stability Gains from Real World Assets Collateral

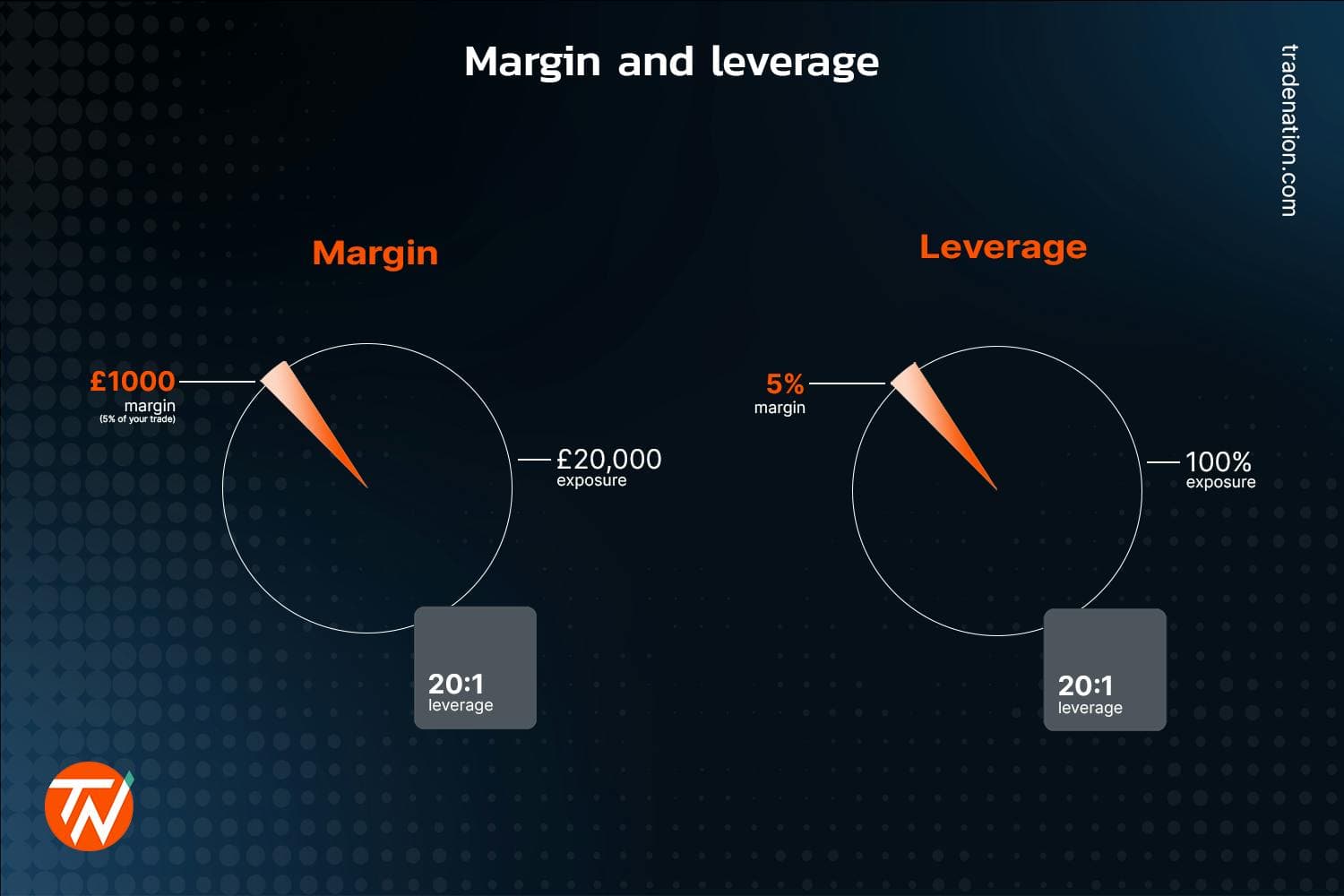

RWAs transform covered calls from speculative bets into income engines. Tokenized treasuries yield baseline returns around 4-5%, but overlaying covered calls on them pushes APYs to 15% and. Unlike naked crypto options, RWA collateral minimizes liquidation cascades during downturns. Gauntlet’s levered vaults exemplify this: deposit RWA tokens, borrow stablecoins, loop into more assets, all within risk-adjusted parameters.

Bitcoin at $66,814 reinforces the narrative; its 24-hour range from $65,683 to $67,252 shows crypto’s choppiness, making RWA-backed strategies a haven. Investors gain exposure without full volatility, ideal for passive income seekers. Still, I’m wary of leverage; even Gauntlet’s automation can’t eliminate black swan events in off-chain RWA redemption.

Leading Protocols Driving RWA Covered Call Adoption

Gauntlet’s levered RWA vaults lead the pack, using Apollo’s tokenized credit funds as collateral to borrow and amplify positions. Derive’s covered call tokens sell weekly upside calls on similar assets, targeting 10-50% annualized yields based on volatility. Frax Finance’s sFRAX integrates RWAs into staked positions for steady drips.

TermMax curates vaults for institutional flows across fixed-rate markets, while Injective’s ecosystem deploys assets onchain and offchain for covered calls and basis trades. These aren’t hype machines; they’re engineered for outperformance with rigorous risk controls. Yields of 15-25% APY emerge in bull markets, but expect 8-12% in sideways grinds, always prioritizing capital preservation.

Ethereum (ETH) Price Prediction 2027-2032

Projections based on current $1,943 base, factoring RWA-collateralized covered calls for DeFi stability (bullish to $2,100, bearish to $1,850)

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $1,850 | $2,500 | $3,200 | +28.7% |

| 2028 | $2,200 | $3,500 | $5,000 | +40.0% |

| 2029 | $2,800 | $4,500 | $7,000 | +28.6% |

| 2030 | $3,500 | $6,000 | $10,000 | +33.3% |

| 2031 | $4,500 | $8,000 | $13,000 | +33.3% |

| 2032 | $6,000 | $10,500 | $16,000 | +31.3% |

Price Prediction Summary

Ethereum’s price is expected to grow progressively from 2027-2032, with average prices rising from $2,500 to $10,500 amid DeFi advancements like RWA-collateralized vaults providing yield stability and reduced volatility. Min/max reflect bearish consolidation and bullish adoption surges.

Key Factors Affecting Ethereum Price

- RWA integration in DeFi vaults (e.g., Gauntlet, Derive) enhancing ETH yields and stability

- Market cycles with post-2026 consolidation leading to 2028 bull run

- Regulatory progress on tokenized assets reducing risks

- Ethereum scalability upgrades and L2 ecosystem growth

- Competition from Solana/others but ETH DeFi dominance

- Macro factors: BTC correlation, institutional adoption via RWAs

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

DeFi vaults passive income via covered calls real world assets isn’t flawless. Hidden loops in collateral models lurk, but selecting T-bills, receivables, or warehouse lines sidesteps them. As yields chase traditional finance, RWAs bridge the gap, yet diversification remains key in this nascent space.

Professional managers like those at TermMax emphasize curated vaults that spread capital across multiple fixed-rate markets, maintaining rigorous oversight to prevent concentration risks. This multi-asset approach aligns with my preference for diversified RWA backed options strategies, ensuring no single protocol dictates outcomes.

Key Risks and Mitigation Strategies

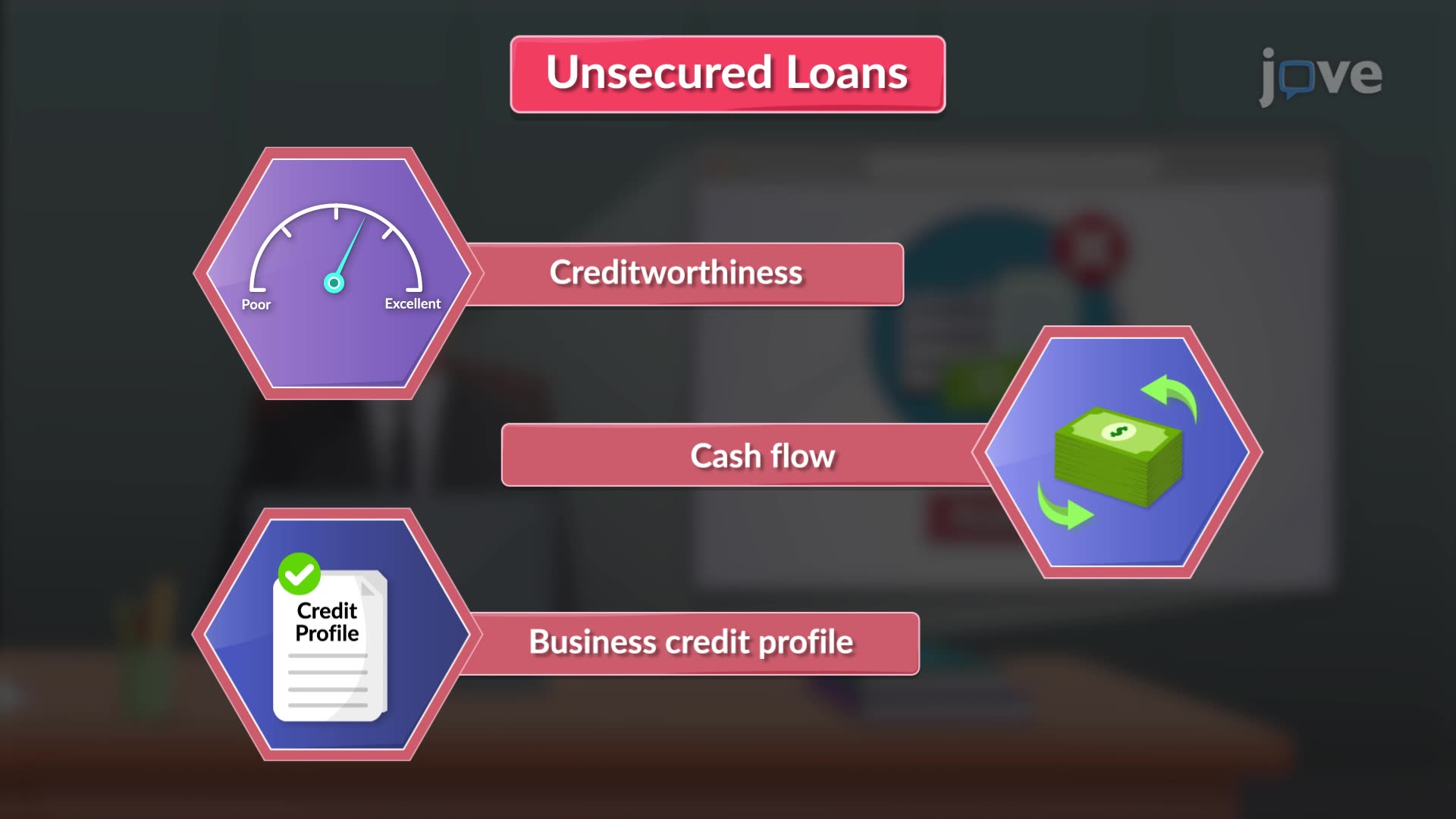

While enticing, RWA collateral covered calls demand vigilance. Smart contract vulnerabilities top the list; even audited code falters under extreme conditions. Redemption risks arise if off-chain RWAs lag, potentially stranding capital during stress tests. Oracle discrepancies could trigger premature liquidations, eroding premiums. Leverage in Gauntlet-style looping amplifies these, turning minor dips into outsized losses.

Benefits of Safe RWA Collateral Models

-

Bankruptcy-remote SPVs isolate assets from parent entity risks, protecting investors in case of issuer bankruptcy. Source

-

T-bills offer high liquidity and low-risk yields as collateral, backed by U.S. government securities.

-

Receivables diversify yield sources beyond treasuries, including trade and consumer receivables for broader income streams.

-

Warehouse lines enable scalable capital deployment, allowing growth without proportional risk increases.

-

Safer oracles reduce manipulation risks with decentralized, multi-source price feeds for accurate RWA valuations.

-

No hidden loops eliminate recursive borrowing risks, unlike levered strategies that amplify volatility.

-

Enhanced stability in DeFi options vaults, combining RWA collateral with covered calls for reduced crypto exposure.

To counter, prioritize vaults with multi-sig governance, over-collateralization ratios above 150%, and proven track records. My rule: never allocate more than 10% of portfolio to any single vault. With Ethereum steady at $1,943.48 amid its tight 24-hour range, these precautions preserve capital when markets test resolve.

DeFi Vault Strategies Risk Comparison

| Strategy | Smart Contract Risk | Redemption Risk | Yield Potential | Recommended Allocation |

|---|---|---|---|---|

| Traditional DeFi | High ⚠️ | N/A | 5-10% 📈 | 20% |

| RWA Covered Calls | Medium ⚠️ | Low 🛡️ | 8-15% 📈 | 40% |

| Levered RWAs | Low 🛡️ | Medium ⚠️ | 15-25% 📈 | 10% |

Implementing RWA Covered Calls for Passive Income

Getting started mirrors traditional covered calls but with DeFi flair. Select a vault from leaders like DeFiOptionsVaults, deposit stablecoins, and let automation handle option sales on RWA-collateralized positions. Monitor via dashboards for premium capture and collateral health. In sideways markets, like Bitcoin’s hover around $66,814 between $65,683 and $67,252, these generate reliable 8-12% APY; bulls unlock 15-25%.

Composability elevates this: pair vaults with lending for compounded yields or liquidity pools for flexibility. Yet, tax implications and gas fees nibble edges; Ethereum’s current price underscores efficiency needs. Conservative sizing, say 5-10% leverage, keeps drawdowns under 5% historically.

Covered calls real world assets shine in portfolios blending 60% stables/RWAs with 40% options overlays. This hedges volatility while chasing superior returns over vanilla DeFi yields.

Looking ahead, as RWAs tokenize more assets like private credit and real estate, covered calls will redefine DeFi baselines. Ethereum’s resilience at $1,943.48 signals maturity; pair it with RWA stability, and passive income becomes predictable. Investors blending caution with innovation will thrive, turning crypto’s chaos into compounded wealth. Diversify, audit relentlessly, and let premiums flow.