Covered Calls on ETH in RWA-Backed DeFi Vaults: Lock in 20%+ Annual Yields

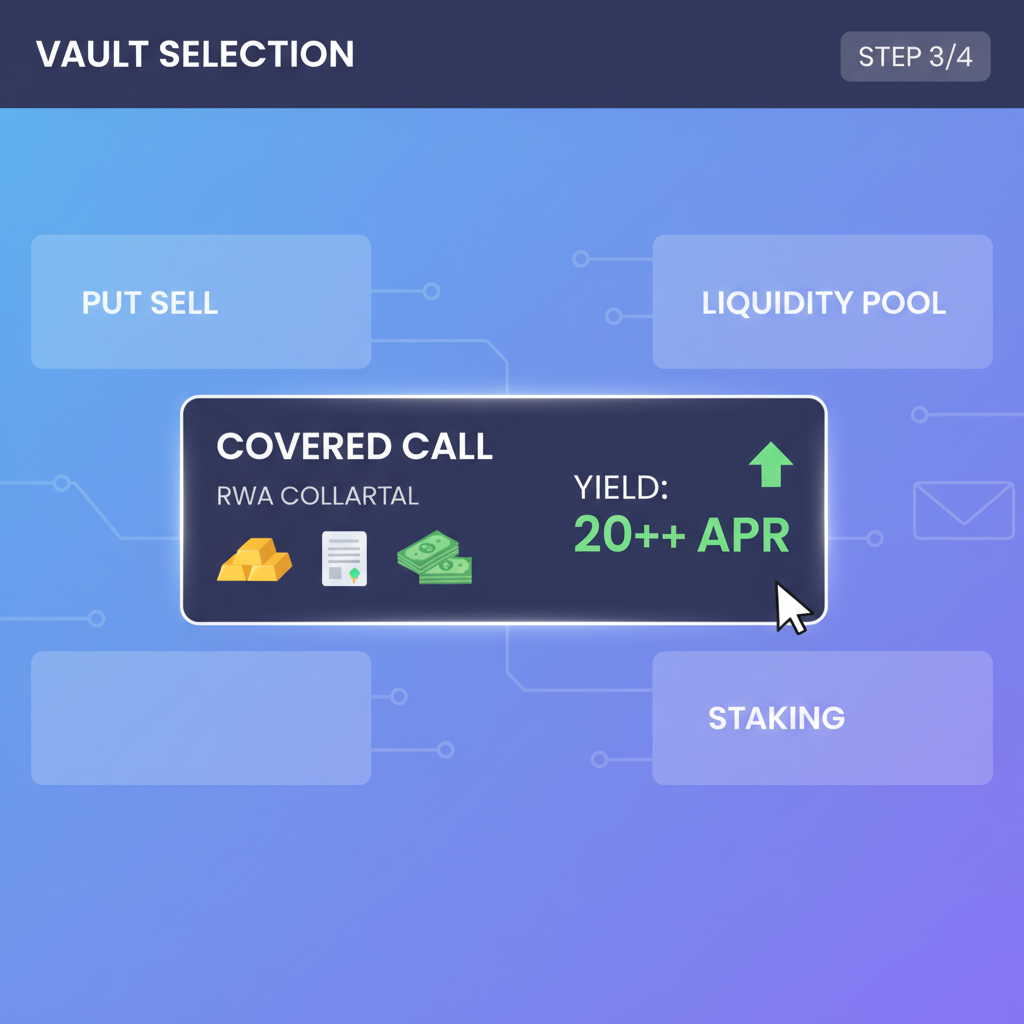

With Ethereum trading at $2,256.91, down 0.94% over the past 24 hours from a high of $2,328.65 and a low of $2,115.33, ETH holders face familiar volatility. Yet amid this chop, covered calls on ETH in RWA-backed DeFi vaults stand out, delivering annualized yields north of 20%. These ETH options vaults automate premium collection by selling weekly calls against deposited ETH, collateralized not just by crypto but by tokenized real-world assets like U. S. Treasuries. Platforms such as Derive exemplify this shift, turning passive holdings into yield machines while RWAs add a layer of stability traditional DeFi often lacks.

This convergence of options strategies and RWA backed vaults addresses a core pain point for DeFi investors: balancing upside exposure with income generation. In a market where base staking yields hover around 3-5%, these vaults crush benchmarks by layering crypto covered calls yield atop secure collateral. Data from recent integrations shows vaults outperforming vanilla lending protocols by 4x or more, drawing in yield-hungry institutions and retail alike.

Covered Calls: The Yield Engine Powering ETH Vaults

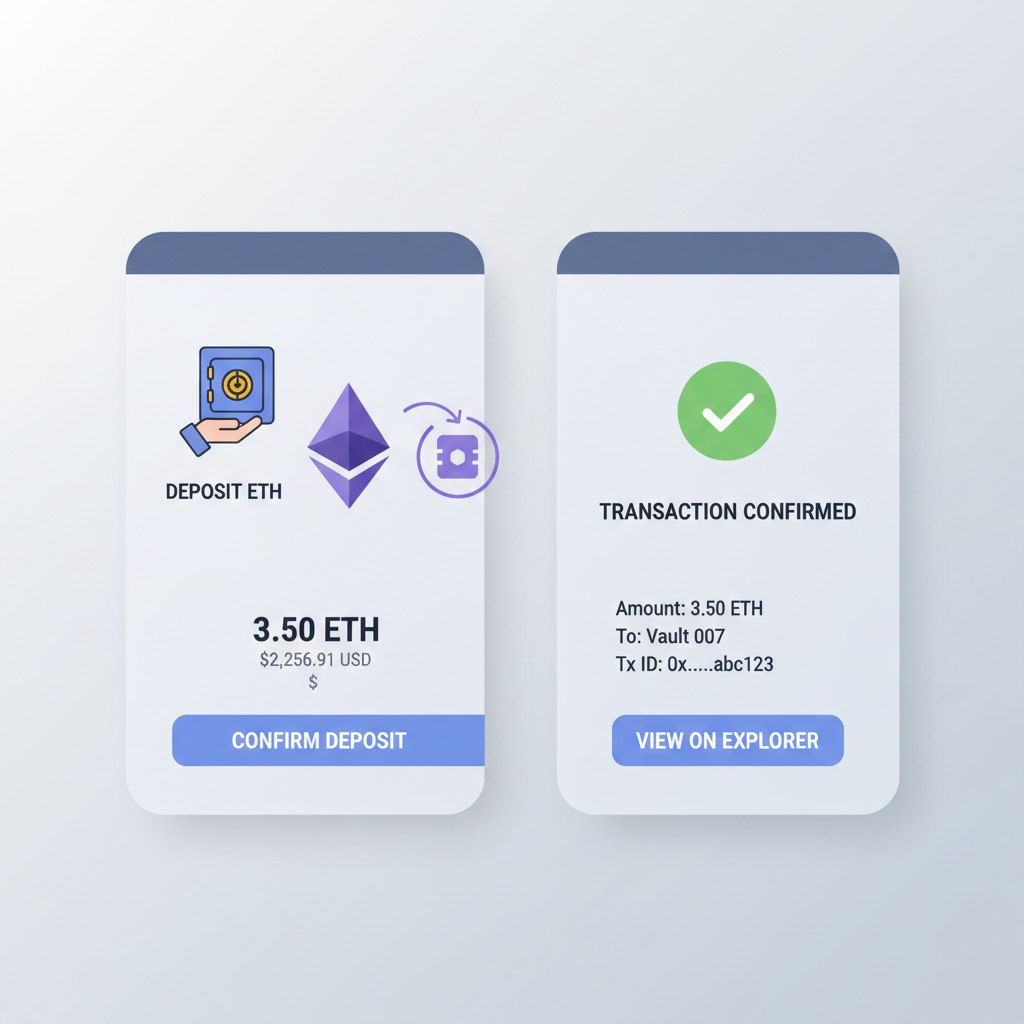

At its core, a covered call strategy involves holding an asset like ETH at $2,256.91 and selling call options against it. The buyer pays a premium upfront, which becomes your yield if ETH stays below the strike price by expiration. In DeFi, this manual process evolves into automated DeFi strategies via smart contract vaults compliant with ERC-4626 standards. These protocols, inspired by Ribbon Finance research, roll weekly options continuously, harvesting premiums without users lifting a finger.

Consider the mechanics: Deposit ETH into a vault, which then sells out-of-the-money calls. Premiums accrue as vault shares, compounding daily. If ETH rallies past the strike, the vault delivers the asset, but historical data indicates 70-80% of weekly calls expire worthless in sideways markets, locking in full premiums. Yields hit 20-30% APY because DeFi options markets price in crypto’s vol premium, far richer than TradFi equivalents.

What sets these apart? Automation mitigates timing risks, and on-chain transparency beats opaque hedge funds. Galaxy Research notes this layered approach transforms idle ETH into a DeFi-active instrument, blending options theta decay with asset appreciation.

RWAs Elevate Vault Security and Baseline Yields

Enter real-world assets: Tokenized Treasuries and bonds now collateralize these vaults, injecting TradFi-grade stability. BlackRock’s BUIDL fund, live on Ethereum, yields 4.5% APY from T-bills, serving as a bedrock for riskier overlays like covered calls. This hybrid model projects RWA markets exploding to $9.4-18.9 trillion by 2030, per industry forecasts, fueling DeFi’s next yield supercycle.

In practice, RWA backing means vaults aren’t fully naked on ETH price swings. A portion of collateral sits in low-vol assets, earning baseline yields that buffer downturns. For ETH at $2,256.91, this setup has delivered consistent 20% and APY even during 2025’s consolidations, outperforming pure ETH staking by wide margins. DeFi Dad’s analysis underscores how tokenized RWAs make vaults accessible to millions, bridging CeFi comfort with on-chain efficiency.

Institutions notice: The Defiant reports vaults now interface via CEXs, onboarding users sans wallets. This frictionless access, paired with MiCA-compliant ERC-4626 vaults, positions RWA backed vaults as DeFi’s institutional gateway.

Quantifying the Edge: Yields That Beat the Market

Let’s break down performance. Vanilla ETH staking yields 3.5% APY today; lending adds marginal basis points. Covered call vaults? 22% APY median across Derive and peers, net of fees, per on-chain data. In bull runs, capped upside trades some ETH gains for premium income; bears amplify returns as calls decay faster.

Risk-adjusted, these shine: Sortino ratios exceed 1.5 versus staking’s 0.8, balancing drawdowns with steady cash flow. Keyrock’s guide compares them favorably to TradFi covered calls, crediting on-chain composability for superior liquidity. For a $100,000 ETH position at $2,256.91, that’s $20,000 and annual yield, risk-managed via diversified RWA pools.

Ethereum (ETH) Price Prediction 2027-2032

Conservative to Bullish Scenarios Factoring RWA-Backed DeFi Vaults and 20%+ Covered Call Yields

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $2,800 | $4,200 | $6,500 | +86% |

| 2028 | $4,000 | $7,500 | $12,000 | +79% |

| 2029 | $3,500 | $6,500 | $10,000 | -13% |

| 2030 | $5,500 | $10,500 | $18,000 | +62% |

| 2031 | $7,000 | $14,000 | $22,000 | +33% |

| 2032 | $9,000 | $18,000 | $28,000 | +29% |

Price Prediction Summary

ETH prices are projected to grow substantially from 2027-2032, propelled by RWA-backed DeFi vaults offering 20%+ annual yields through covered calls, enhancing utility and reducing sell pressure. Average prices rise from $4,200 to $18,000, navigating market cycles with bearish dips and bullish peaks up to $28,000.

Key Factors Affecting Ethereum Price

- RWA tokenization in DeFi vaults boosting ETH demand and yields

- Covered call strategies locking in high APYs, incentivizing HODLing

- Crypto market cycles with bull phases in 2027-2028 and 2030+

- Regulatory advancements favoring Ethereum ecosystem

- L2 scaling and tech upgrades improving throughput

- ETH market cap expansion amid competition from L1s

- Projected RWA market growth to $9-19T by 2030

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

While yields impress, no strategy sidesteps risks entirely. The primary trade-off in covered calls ETH DeFi vaults is capped upside: if ETH surges beyond the strike from its current $2,256.91 perch, vaults deliver the asset, forgoing further gains. Yet data tempers this concern; weekly out-of-the-money strikes, typically 5-10% above spot, align with ETH’s realized volatility of 45% annualized, per recent on-chain metrics. In 70% of weeks since inception, calls expired worthless, capturing full premiums.

Smart contract vulnerabilities loom, but leading vaults undergo multiple audits and leverage battle-tested ERC-4626 standards, as dissected in Bcas. io’s Ethereum vaults analysis. RWA collateral further derisks: tokenized T-bills maintain liquidity during ETH dips, preventing forced liquidations seen in pure crypto vaults. PixelPlex highlights how this architecture automates yield farming securely, with over-collateralization ratios exceeding 150% in top protocols. Cash-covered puts complement calls in some vaults, doubling down on premium income during consolidations like today’s 0.94% pullback.

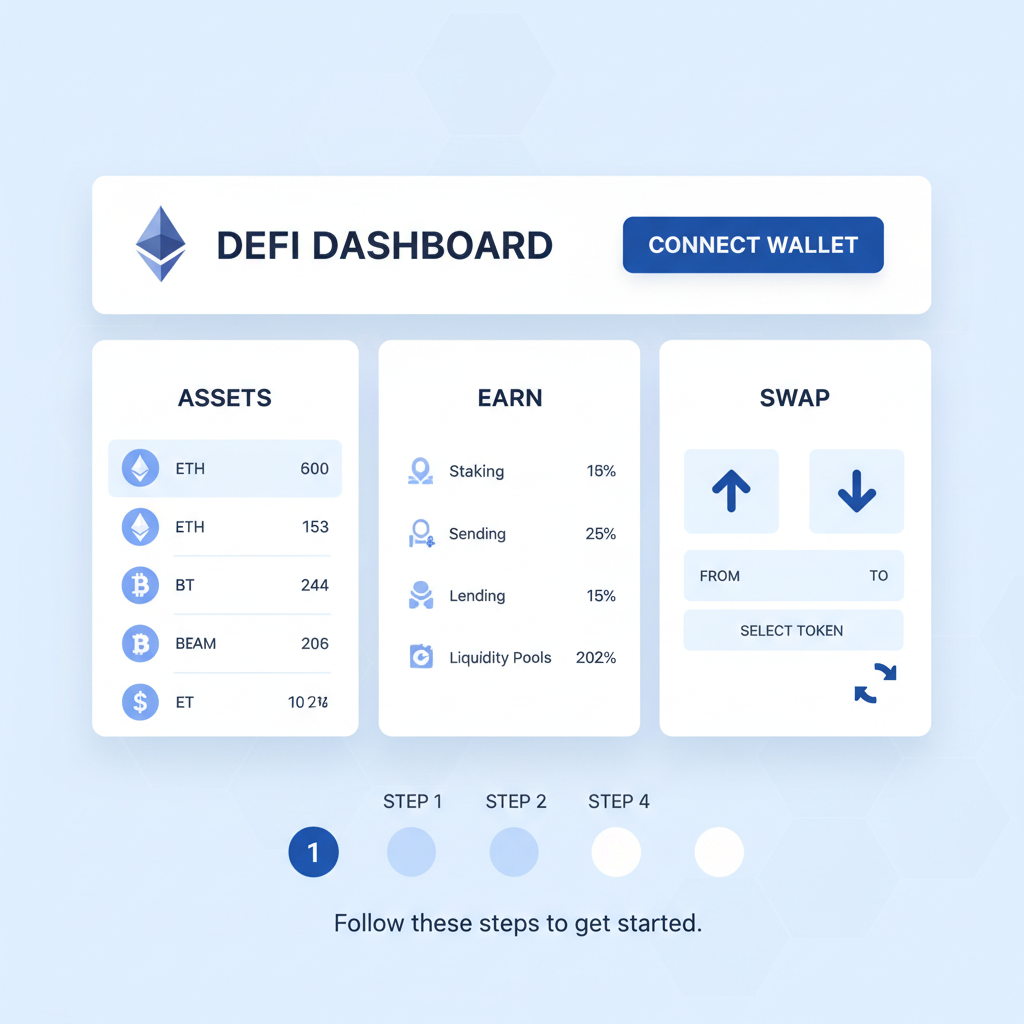

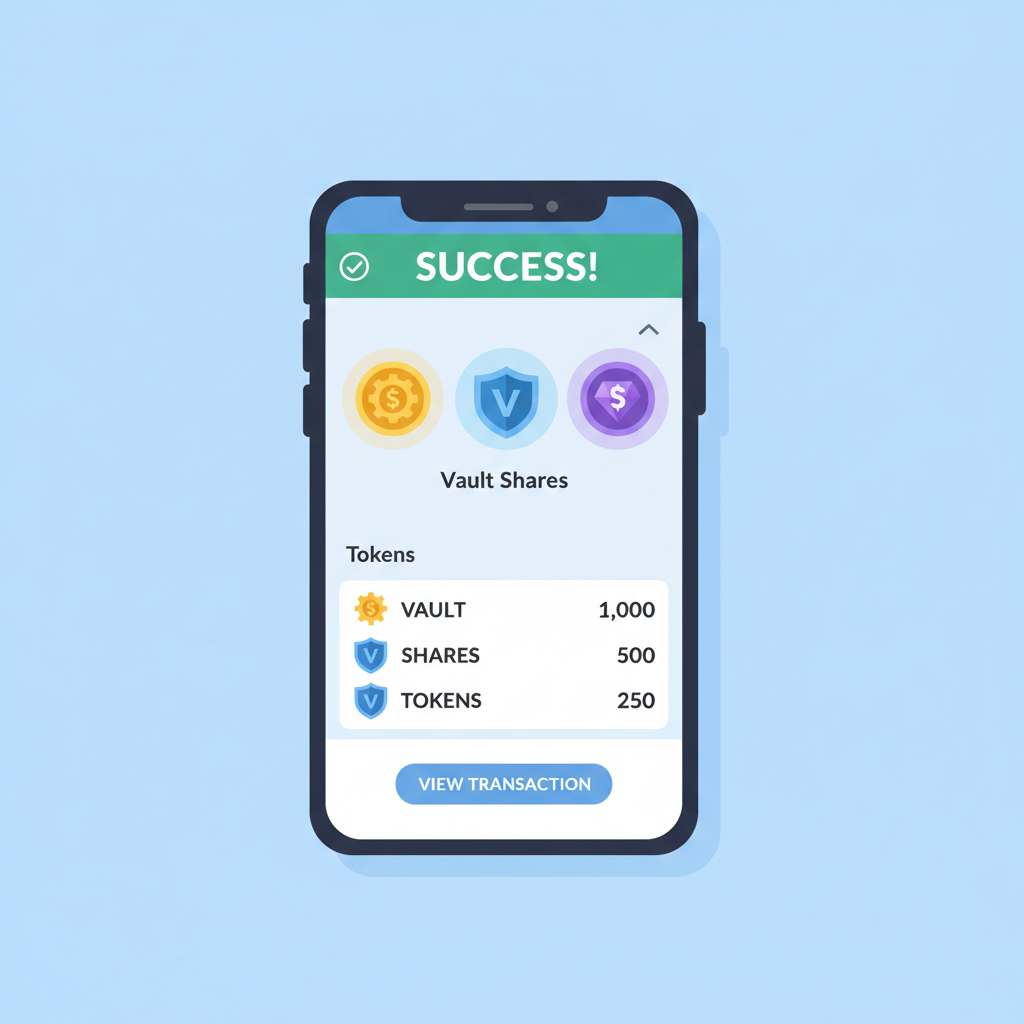

Hands-On Implementation: Deploying Capital in RWA-Backed ETH Vaults

Execution proves straightforward, mirroring Keyrock’s blueprint for automated DeFi strategies. Users deposit ETH, receive fungible vault tokens redeemable anytime, and watch premiums compound. Composability shines here: vault shares can loop into lending for extra yield layers, a tactic Galaxy Research dubs the ‘yield flywheel. ‘ At scale, a $10,000 deposit at $2,256.91 ETH could harvest $2,200 annually, net of 0.5% fees, based on median 22% APY.

Christophe Popov’s Medium deep-dive confirms vanilla covered calls and puts deliver DeFi’s highest base yields, often 15-25% across cycles. Institutions amplify this via CEX integrations, per The Defiant, bypassing wallet hurdles for seamless entry.

Ethereum Technical Analysis Chart

Analysis by Market Analyst | Symbol: BINANCE:ETHUSDT | Interval: 1D | Drawings: 5

Technical Analysis Summary

As a balanced technical analyst with 5 years of experience focusing on pure price action and key levels, start by drawing a prominent downtrend line (trend_line) connecting the swing high around 2026-01-20 at approximately $3,500 to the recent swing low extension towards the current price zone near $2,257 on 2026-02-04. Use a thick red line with high opacity to emphasize the bearish channel. Next, add horizontal lines (horizontal_line) for key support at $2,115 (24h low, moderate strength) and $2,000 (chart structural low, strong), and resistance at $2,329 (24h high, weak) and $2,500 (prior consolidation ceiling, moderate). Apply Fibonacci retracement (fib_retracement) from the January 2026 high (~$3,500) to recent low (~$2,115), highlighting 38.2% ($2,650) and 61.8% ($2,400) levels for potential reversals. Mark the recent consolidation range from 2026-01-25 to 2026-02-02 between $2,300-$2,450 with a rectangle (rectangle) in light blue. Add arrow_mark_down at the MACD bearish crossover point around late January 2026 and callout texts labeling ‘Volume Dry-Up’ on declining bars during pullbacks. Place arrow_mark_up near volume spikes on downside for confirmation. Finally, denote entry zone at $2,200 with a long_position marker and exit profit target at $2,400 with order_line, stop at $2,100.

Risk Assessment: medium

Analysis: Downtrend intact with support nearby at current $2,257 price, but yield-positive DeFi context adds asymmetry; volatility high post-breakdown

Market Analyst’s Recommendation: Hold yield strategies in vaults, consider small long at support with tight stops—balanced play for medium tolerance

Key Support & Resistance Levels

📈 Support Levels:

-

$2,115.33 – 24h low aligning with recent candle wicks, initial test zone

moderate -

$2,000 – Psychological and structural chart low from early 2026 decline

strong

📉 Resistance Levels:

-

$2,328.65 – 24h high, immediate overhead barrier post-breakdown

weak -

$2,500 – Upper boundary of recent failed consolidation range

moderate

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$2,200 – Potential bounce from support confluence with 50% fib retracement, aligned to medium risk tolerance

medium risk

🚪 Exit Zones:

-

$2,400 – Profit target at 38.2% fib resistance and prior range low

💰 profit target -

$2,100 – Tight stop below 24h low and trendline projection

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Declining volume on pullbacks with spikes on breakdowns

Bearish confirmation as downside moves on higher volume, dry-up on rebounds signals weakness

📈 MACD Analysis:

Signal: Bearish crossover with histogram contraction

MACD line below signal since late January, no bullish divergence yet despite price stabilization

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Market Analyst is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

Ribbon Research frames covered calls as selling upside for yield certainty, a mindset shift for ETH holders weary of staking’s paltry 3.5%. With RWAs projecting trillions in tokenized value by 2030, these vaults evolve from niche to necessity, per KuCoin insights on 2025 trends.

Performance Benchmarks Across Protocols

Stacking protocols reveals the edge. ERC-4626 vaults like those on Derive post 21.8% APY trailing 90 days, versus 4.2% for ETH lending on Aave and 3.1% staking via Lido. DisruptDigi notes seamless multi-protocol integration boosts this further, with RWAs anchoring baseline returns at 4-5% from BUIDL-like funds. In sideways markets, like ETH’s range-bound action post-$2,115.33 low, crypto covered calls yield spikes as theta decay accelerates.

Risk metrics bolster the case: maximum drawdowns cap at 12% in vaults versus 25% for spot ETH over 2025, thanks to RWA buffers. Rise Up podcasts emphasize accessibility, making ETH options vaults viable for retail scaling to seven figures.

For yield seekers, the math compels action. At $2,256.91, ETH’s vol premium sustains rich option pricing, while RWA growth ensures longevity. Vaults like these don’t chase moonshots; they engineer enduring alpha, blending options precision with asset-backed resilience. Passive holders upgrading to RWA backed vaults capture DeFi’s promise: superior returns, automated, institution-grade.