RWA Collateralized Covered Puts in DeFi Vaults: High Premiums on SOL with Built-in Protection

In the volatile world of DeFi, where yields chase the horizon, RWA collateralized covered puts on SOL emerge as a compelling strategy for cautious investors. With SOL trading at $96.83 after a -5.76% dip from its 24-hour high of $103.38, these vaults offer high premiums backed by tokenized real-world assets, blending options income with stability. This approach sidesteps the pitfalls of naked puts by securing positions with premium RWAs like tokenized treasuries or real estate, providing built-in protection against SOL’s downside swings.

Solana Technical Analysis Chart

Analysis by Michael Thompson | Symbol: BINANCE:SOLUSDT | Interval: 1D | Drawings: 6

Technical Analysis Summary

As Michael Thompson, my conservative technical analysis on this SOLUSDT chart emphasizes risk-managed setups aligned with RWA yield strategies on Solana. Draw a primary downtrend line from the July 2026 peak at 240 connecting to November 2026 low around 100, using ‘trend_line’ with red color for bearish bias. Add horizontal support at 96.50 (24h low) and resistance at 103.38 (24h high) as ‘horizontal_line’. Mark consolidation rectangle from September to October 2026 between 180-220 using ‘rectangle’. Use ‘fib_retracement’ from July high 240 to November low 100, highlighting 50% retracement at ~170. Place ‘callout’ on declining volume during downtrend and MACD bearish crossover in October. Entry zone: long above 103 with stop below 96, but only for covered put collateral strategies. Overall, prioritize preservation over speculation.

Risk Assessment: high

Analysis: Sharp -5.76% drop to 96.83 with broken uptrend and bearish MACD signals elevated volatility; RWA fundamentals intact but technical correction dominates

Michael Thompson’s Recommendation: Stay sidelined or use for premium selling in protected vaults like Cork’s; no directional bets until support holds with volume. Preserve capital.

Key Support & Resistance Levels

📈 Support Levels:

-

$96.51 – 24h low and psychological support near current 96.83

strong -

$95 – Minor extension below 24h low, BB lower band

moderate

📉 Resistance Levels:

-

$103.38 – 24h high, initial resistance

moderate -

$120 – Prior consolidation low, 50% fib retracement partial

weak

Trading Zones (low risk tolerance)

🎯 Entry Zones:

-

$102 – Bounce above 24h high with volume confirmation for low-risk RWA vault entry

low risk -

$96 – Strong support hold for conservative put-writing collateral build

medium risk

🚪 Exit Zones:

-

$110 – Profit target at minor resistance for covered strategies

💰 profit target -

$95 – Tight stop below support to protect capital

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: declining on down candles

Bearish divergence: low volume on pullback suggests weak selling pressure

📈 MACD Analysis:

Signal: bearish crossover in October 2026

MACD line below signal with histogram negative, confirming downtrend

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Michael Thompson is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (low).

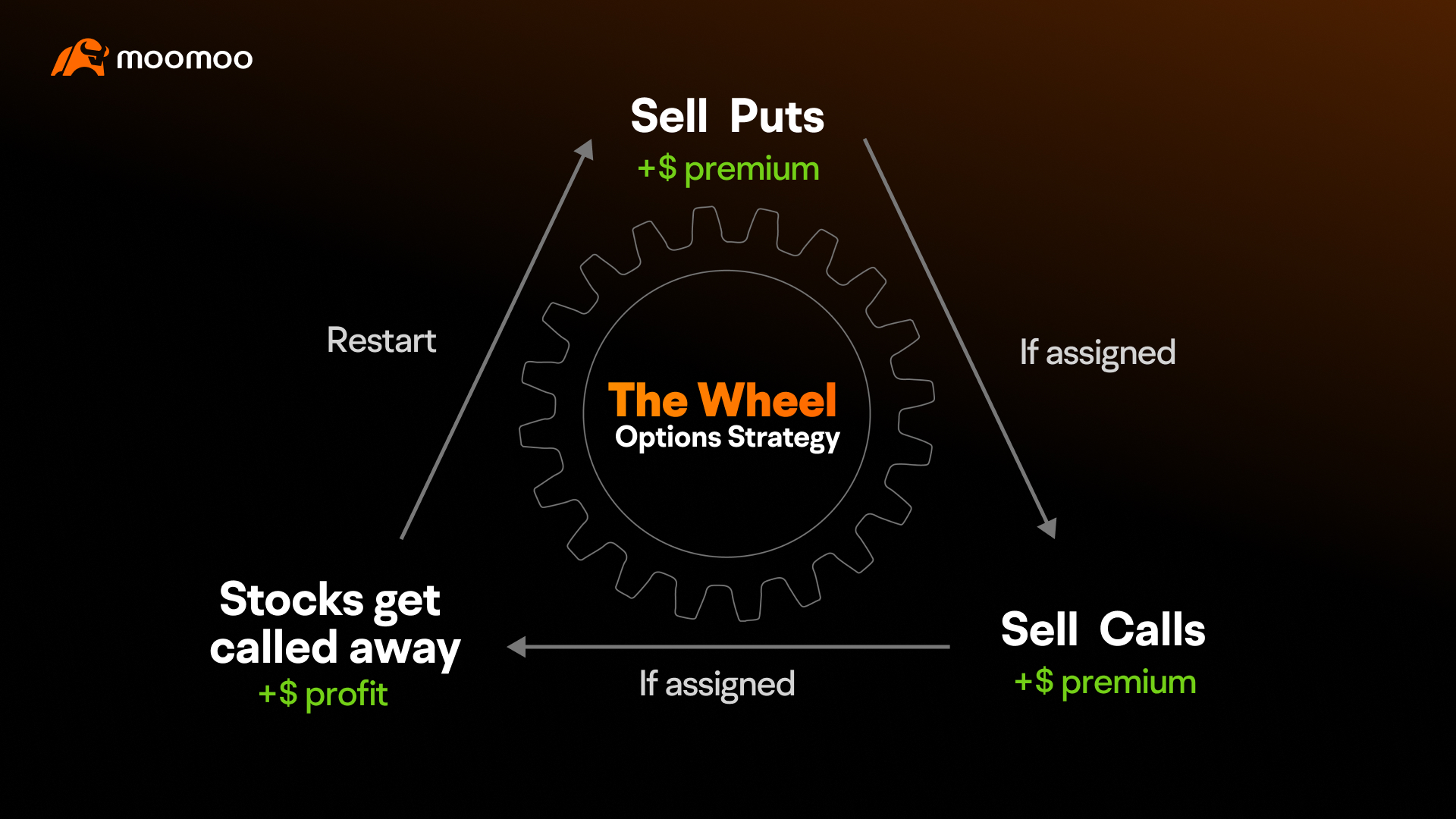

Decoding Covered Puts in DeFi Options Vaults

Covered puts, or cash-secured puts, involve selling put options while holding sufficient collateral to buy the underlying asset if exercised. In DeFi, this translates to locking RWAs in smart contract vaults on Solana, where protocols automate the selling of puts against SOL. Unlike traditional covered calls that cap upside, covered puts DeFi SOL strategies profit from premium collection during sideways or mild declines, with RWAs ensuring collateral quality far superior to volatile crypto holdings.

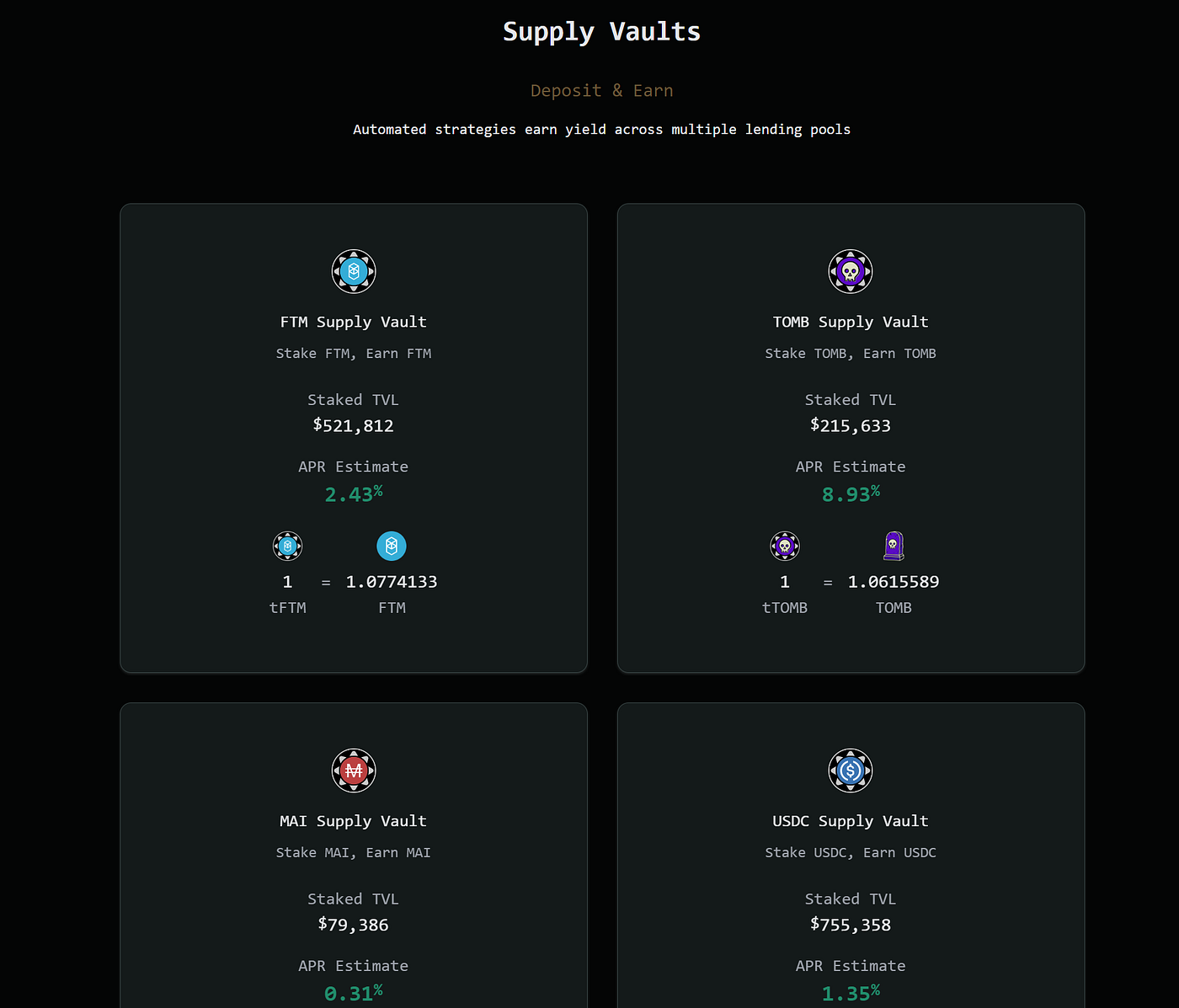

Consider the mechanics: deposit tokenized treasuries into a vault like those inspired by Ribbon or Opyn models adapted for Solana. The vault mints put options, sells them for upfront premiums, and uses RWA backing to cover potential assignments. If SOL stays above the strike, premiums compound as yield; if not, RWAs absorb the hit without liquidation cascades common in overleveraged positions. Current market data underscores the appeal: at $96.83, implied volatility spikes premiums, potentially yielding 15-25% annualized on conservative strikes, dwarfing stablecoin rates.

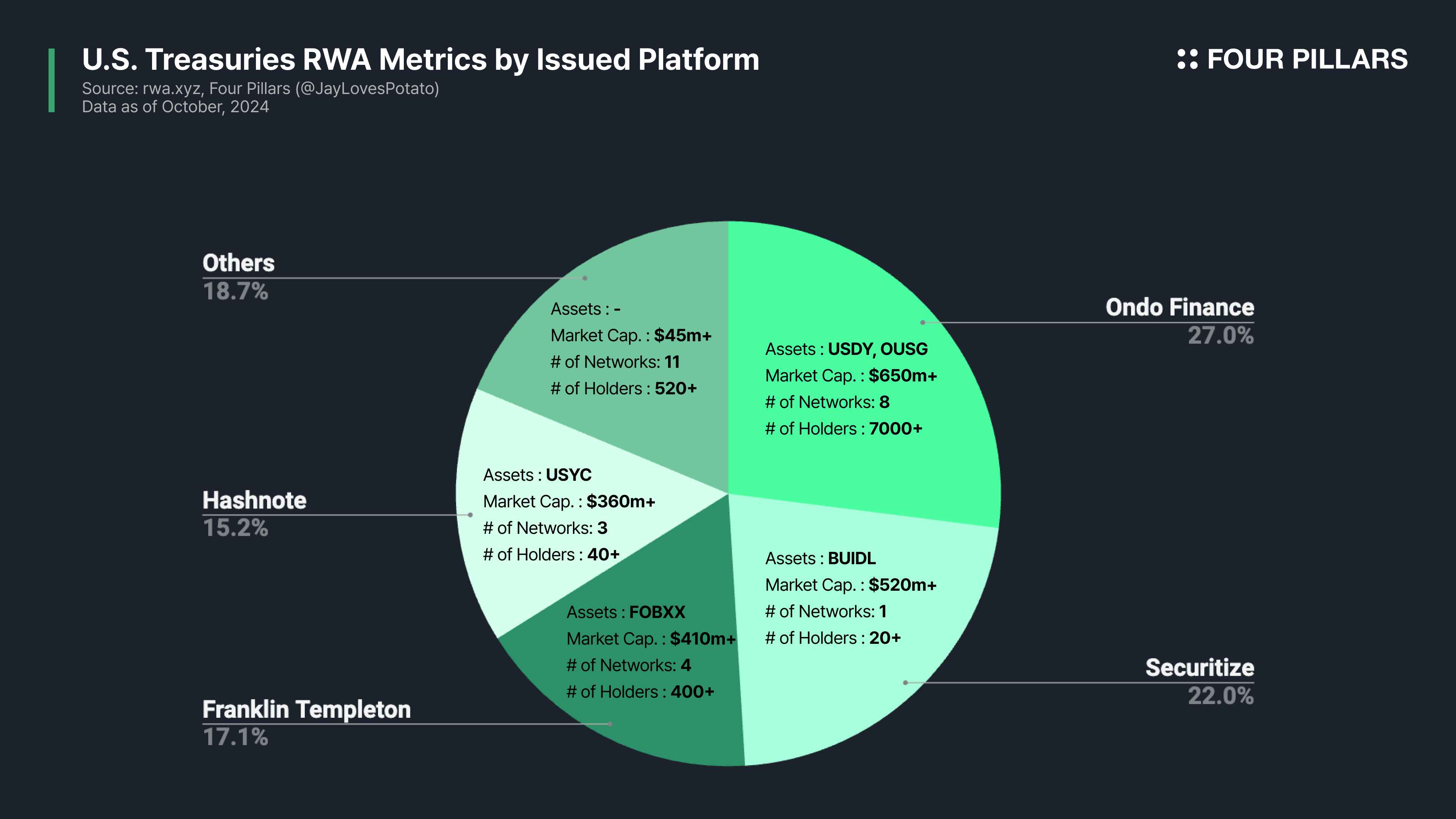

Solana’s RWA Ecosystem Fuels High-Yield Vaults

Solana’s high-throughput blockchain has become a hotbed for RWA collateral puts, with integrations accelerating. Gauntlet’s levered RWA strategy deploys tokenized assets to borrow stablecoins for looping, optimized for risk via engines that maintain healthy collateral ratios. Available on Drift, it mirrors covered put dynamics by scaling exposure safely. Apollo’s ACRED fund, tokenized with over $1.2 billion AUM, plugs into Kamino’s Multiply for automated looping, letting RWAs underpin SOL options plays.

| Strategy | Platform | Collateral Type | Est. APY | Risk Mitigation |

|---|---|---|---|---|

| Levered RWA Loop | Gauntlet/Drift | Tokenized Treasuries | 12-18% | Dynamic Ratio Mgmt |

| ACRED Multiply | Kamino | ACRED Tokens | 15-22% | Smart Contract Loops |

| Protected Loops | Cork | Yield-Bearing RWAs | 10-20% | Liquidity Hedges |

Cork’s Protected Loops stand out, embedding liquidity hedges to shield long-duration RWAs from duration risk in looping vaults. This enables SOL options vaults to write puts without exposing lenders, channeling liquidation fees back to liquidity providers for amplified DeFi covered put yields.

Navigating Risks in Risk-Managed Crypto Puts

While premiums tempt, caution reigns. SOL’s 24-hour low of $96.51 highlights volatility; a sharp drop below strikes could force assignment, tying up RWAs at depressed prices. Yet, RWA stability – think treasuries yielding 4-5% baseline – cushions this, outperforming crypto collateral prone to spirals. Vaults like those from Plume or Boros automate health checks, borrowing limits, and rebalancing, but users must eye health factors amid Solana’s network hiccups.

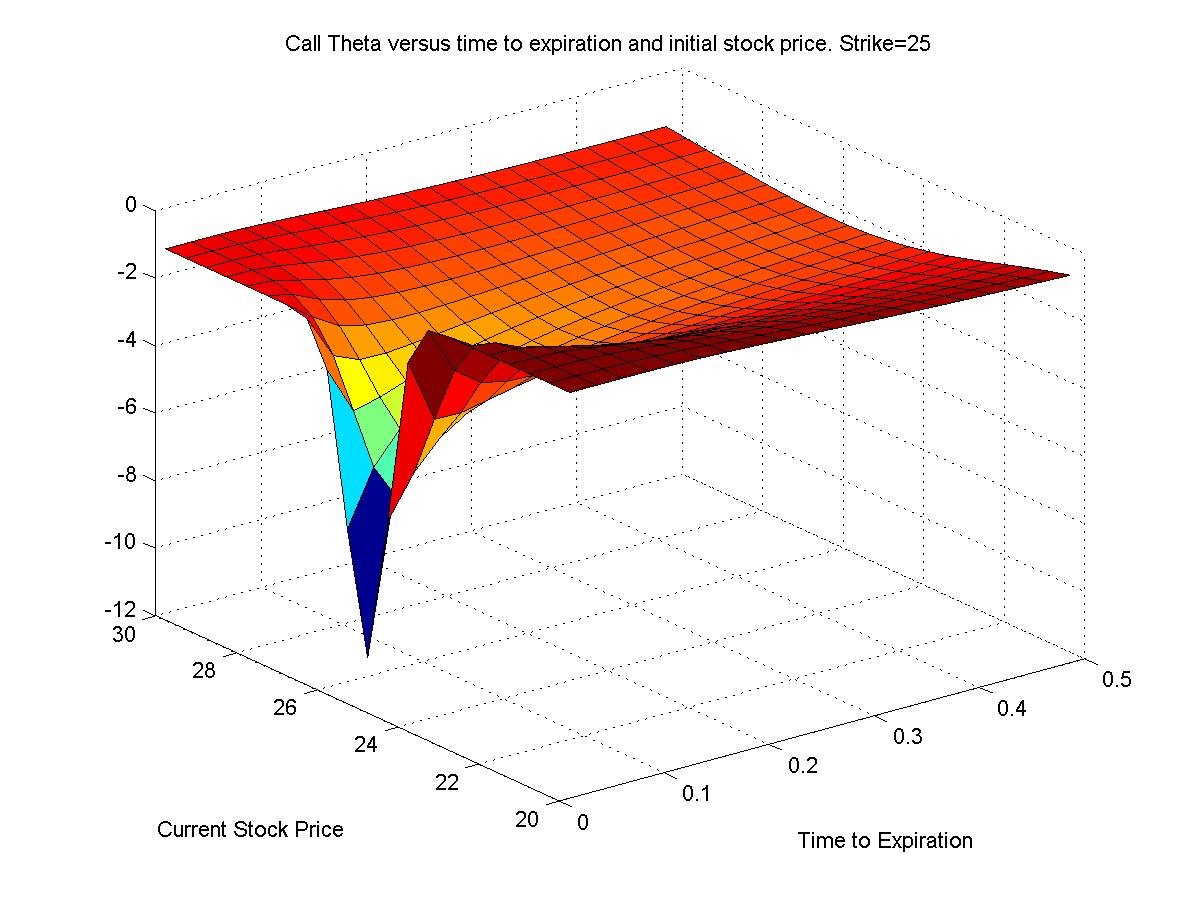

My 15 years in traditional finance underscore: true edge lies in asymmetry. These vaults tilt odds via theta decay on puts, where time favors sellers. With SOL at $96.83 consolidating post-dip, strikes at $90 offer juicy premiums without aggressive bets, aligning with conservative mandates. Early adopters report yields 2-3x traditional DeFi, but diversification across vaults remains prudent against protocol risks.

Protocol audits and insurance layers further bolster these risk-managed crypto puts, drawing from models like Ribbon’s automated vaults that lock collateral before minting and selling options. Yet, smart money watches onchain metrics: collateral ratios above 150%, premium-to-risk ratios favoring sellers, and vault TVL signaling protocol maturity. In my view, these metrics separate sustainable strategies from yield traps.

Comparison of SOL Yield Strategies at $96.83 SOL Price

| **Strategy** | **Collateral** | **Est. APY** | **Downside Protection** | **Upside Cap** |

|---|---|---|---|---|

| **RWA Collateralized Covered Puts** 🟢 | RWAs | 18-30% 📈 | High 🛡️ (RWA-backed, acquire SOL at discount) | None |

| Covered Calls | SOL | 15-25% | Medium | Strike price |

| Staking SOL | SOL | <10% 📊 | None | None |

| Stablecoin Lending | USDC | 5-12% | High | None |

Recent integrations amplify this. Plume’s vaults on Loopscale enable leveraged RWA looping for SOL puts, rehypothecating treasuries to stack yields without added principal risk. Helius reports Solana’s RWA diversity – from tokenized bonds to real estate – now exceeds $500 million TVL, fueling options vaults with stable inflows. Boros-style automation handles collateral health, borrowing caps, and position rolls, minimizing gas fees on Solana’s efficient chain.

Key Benefits of RWA Covered Puts on SOL

-

High premiums from SOL volatility at $96.83 (24h high $103.38, low $96.51, –5.76%).

-

RWA stability vs volatile crypto collateral, e.g., tokenized funds like Apollo ACRED.

-

Automated vaults like Kamino and Gauntlet on Solana reduce active management.

-

Theta decay generates income as put premiums erode over time.

-

Assignment allows buying SOL at a discount to market if exercised.

Real-World Protocols Powering SOL Options Vaults

Drift and Morpho host Gauntlet’s loops, where RWAs borrow against SOL puts, optimization engines dialing leverage to 2-3x within 120% collateral buffers. Kamino’s Multiply with ACRED automates this for institutions, health factors dynamically adjusted post-SOL’s -5.76% drop to $96.83. Cork’s hedges embed options-like protection, converting illiquid RWAs into looping-eligible assets. These primitives evolve DeFi covered put yields, channeling institutional capital into retail-accessible vaults.

From my traditional finance lens, this mirrors cash-secured puts on indices, but supercharged by DeFi composability. Tokenized treasuries at 4.5% yield floor RWA collateral, while SOL at $96.83 offers put premiums inflated by its 24-hour range from $96.51 to $103.38. Early data from Medium analyses peg cash-secured DeFi puts at 20% and APY, net of fees, with RWAs slashing drawdowns by 40% versus pure crypto strategies.

Challenges persist: oracle risks could misprice puts during SOL flash crashes, and RWA tokenization adds custody layers. Yet, regulated stables like sDAI proposals on Aave signal maturing compliance, vital for scaling. Vaults from ETHGlobal-inspired RWA protocols on Mantle hint at cross-chain ports, but Solana leads with speed.

For yield-hungry investors, allocate 10-20% to these vaults amid diversification. Monitor SOL’s $96.83 base against $96.51 support; premiums shine brightest here, post-dip. As tokenized RWAs proliferate, SOL options vaults with covered puts redefine passive income, securing crypto’s wild ride with tangible asset anchors. Conservative hands will harvest these premiums methodically, building wealth one theta tick at a time.