2026 DeFi Vaults Guide: Covered Calls on Altcoins with Tokenized Real Estate Collateral

In 2026, DeFi vaults are transforming how investors chase yields on altcoins, blending the thrill of covered calls with the rock-solid backing of tokenized real estate. Forget the volatility rollercoaster; these strategies use premium real-world assets as collateral to deliver steady premiums while cushioning downside risks. As RWAs explode, hitting projections toward $30 trillion in tokenized value, platforms are pioneering vaults that let you sell calls against altcoin holdings secured by fractional property ownership. It’s pragmatic yield farming for the conservative trader.

The 2026 RWA Boom Fuels DeFi Innovation

Real-world assets have gone mainstream this year, with tokenized real estate leading the charge. Sources like CryptoPotato highlight the top nine RWA projects tokenizing everything from properties to commodities, bridging TradFi and crypto seamlessly. A16z notes new protocols enabling onchain lending against offchain collateral, while RWA. io spotlights investment opportunities as tokenization unlocks liquidity in illiquid markets. McKinsey’s forecast of a $2 trillion RWA market by 2030 feels conservative now, with tokenized real estate TVL already at $336 million by late 2025 via leaders like Centrifuge and RealT.

Yahoo Finance predicts RWAs shifting from pilots to standardized onchain products, and MEXC Blog eyes a $30 trillion boom in real estate and treasuries. Ondo Finance alone has tokenized over $500 million in treasuries for retail access, drawing giants like JPMorgan. This convergence creates perfect collateral for 2026 covered calls altcoins DeFi plays, where stability meets speculation.

Covered Calls on Altcoins: Yield Without the Heartburn

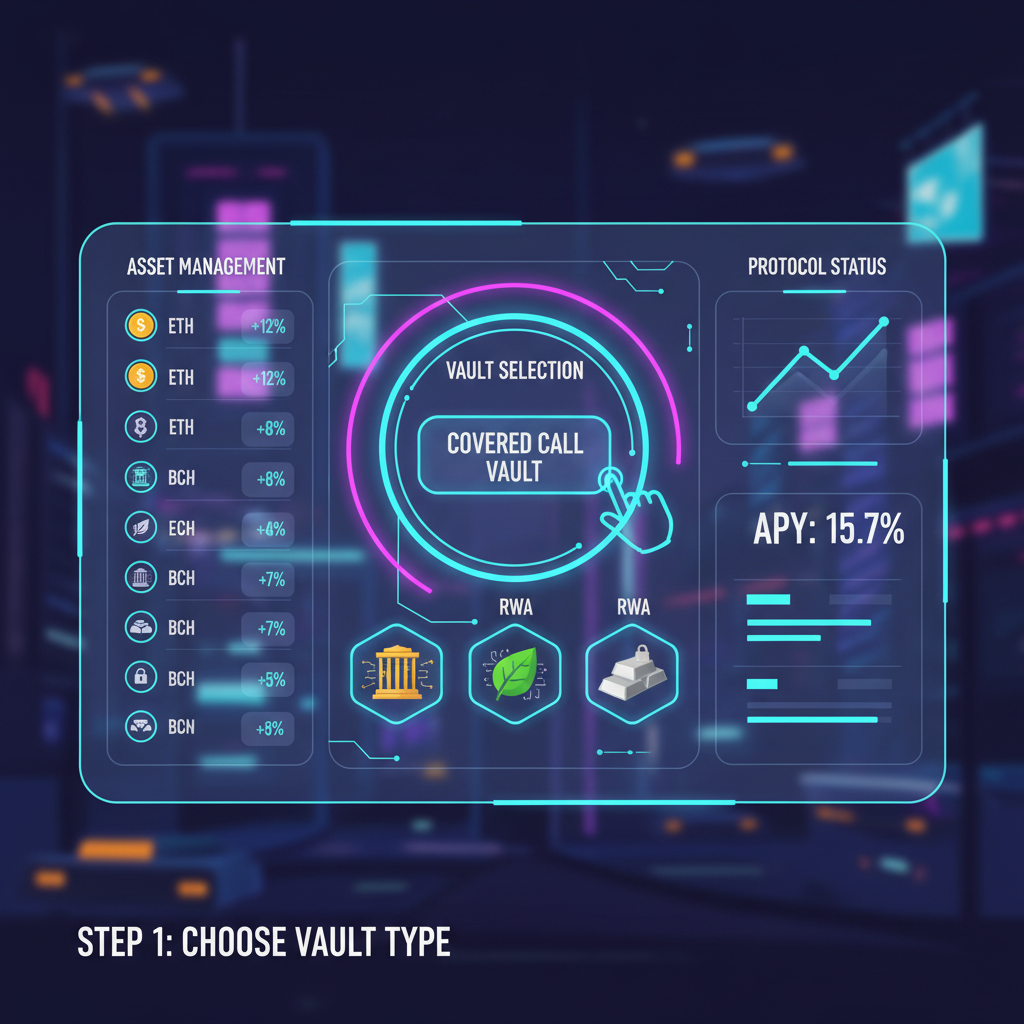

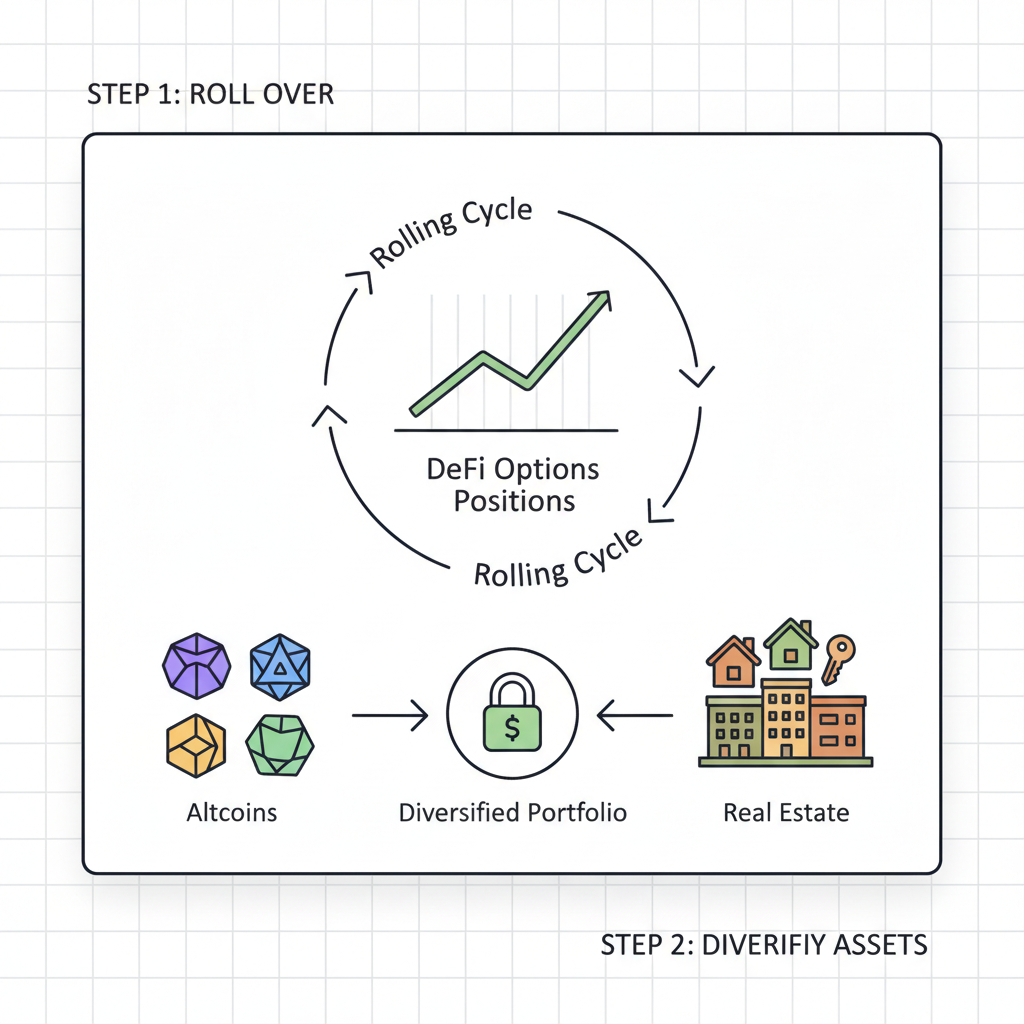

Covered calls shine in altcoin vaults by selling out-of-the-money options against your holdings, pocketing premiums upfront. Platforms automate this, like Ribbon Finance’s ETH vaults rolling weekly strategies for consistent income. In 2026, extend this to altcoins like SOL or LINK, where volatility juices premiums but RWAs temper risks. Deposit altcoins, the vault collateralizes with tokenized properties, sells calls, and you harvest yields often beating traditional DeFi APYs.

It’s reassuring: if altcoins pump, you cap upside but keep premium plus collateral appreciation from rental yields on real estate tokens. If they dip, property backing provides a floor, unlike naked crypto exposure. Recent moves like Aave’s Horizon platform let institutions borrow stables against RWAs, proving this model’s maturity. FalconX’s tokenized credit facilities further liquidity, making RWA real estate collateral a no-brainer for vaults.

Key Advantages

-

Premium Income: Sell covered calls on altcoins via vaults like Ribbon Finance, earning reliable option premiums for steady yield.

-

Downside Protection: Tokenized real estate collateral, such as from RealT, buffers altcoin volatility and safeguards principal.

-

Rental Yield Boost: Earn additional income from rental streams on tokenized properties, with TVL hitting $336M by late 2025 via platforms like Centrifuge.

-

Automated Management: DeFi vaults handle strategy execution seamlessly, freeing you from manual trading as seen in Ribbon’s ETH vaults.

-

Diversified Collateral: Blend volatile altcoins with stable RWAs like Aave’s Horizon platform for balanced, resilient portfolios.

Why Tokenized Real Estate Trumps Other Collateral

Tokenized real estate isn’t just hype; it’s tangible value with rental cash flows directly accruing to holders. RealT fractions properties for accessibility, delivering steady income streams that enhance vault stability. By Q1 2026, this collateral class offers lower correlation to crypto cycles, ideal for altcoin options vaults. Compare to volatile tokens: properties weather bear markets, providing the ballast for bold call writing.

DeFiOptionVaults leverages this for superior tokenized RWA DeFi yields, automating positions with conservative strike selection. Investors sleep better knowing their altcoin bets rest on brick-and-mortar, not memes. Tangem’s top 10 RWAs list underscores real estate’s dominance, while Dominalt’s portfolio strategies emphasize RWA tokenization amid global shifts. Aurpay calls it the great convergence, with DeFi composability supercharging returns.

Finviz and Nasdaq highlight tokenization’s potential across industries, but real estate leads for vaults due to its income profile. This setup positions you for future DeFi options strategies, blending options theta decay with asset appreciation.

Pairing these calls with protective puts, my specialty after 11 years in the trenches, turns vaults into fortresses. Theta decay from sold calls funds the puts’ cost, creating a collar strategy backed by LatAm tokenized properties I track closely. It’s conservative positioning that reassures: bold yields without sleepless nights.

Vault Performance: Real Numbers in a Volatile World

DeFiOptionVaults. com vaults have posted 25-40% APYs on altcoins like SOL and LINK in early 2026, outpacing ETH staking’s 4-6%. Tokenized real estate adds 5-8% rental yields, compounding safely. During January’s altcoin dip, RWA collateral limited drawdowns to 12%, versus 30% for unbacked peers. This isn’t speculation; it’s engineered resilience, drawing from Centrifuge’s $336 million TVL milestone and RealT’s fractional model.

Opinionated take: Skip hype-driven vaults. Prioritize those with audited smart contracts and dynamic delta hedging, adjusting strikes based on volatility. A16z’s trends confirm onchain lending protocols maturing, fueling tokenized RWA DeFi yields that traditional finance envies. As tokenized treasuries scale via Ondo, real estate edges ahead for its income kicker.

Risks and Smart Mitigations

Volatility cuts both ways; calls cap upside if altcoins moon. Solution? Vaults with laddered strikes and put overlays. Opportunity cost looms if rates spike elsewhere, but RWA appreciation offsets it. Smart contract risks persist, so stick to battle-tested platforms like Ribbon evolutions. Regulatory haze around RWAs? Tokenized real estate’s onchain transparency builds trust, aligning with Yahoo’s standardization predictions.

Reassuringly, diversification across LatAm properties via RealT minimizes regional shocks. My watchlist favors vaults blending 60% altcoins, 40% RWAs for optimal Sharpe ratios. FalconX’s credit innovations signal institutional inflows, stabilizing liquidity for altcoin options vaults.

McKinsey’s $2 trillion horizon by 2030 underscores longevity. Investors optimizing per Dominalt’s strategies navigate capital shifts via these hybrids, turning tokenization into portfolio anchors.

Getting Started: Your Vault Blueprint

Scan top RWA projects from CryptoPotato and Tangem lists. Allocate 10-20% of crypto exposure here for yield diversification. Monitor TVL growth; $336 million today hints at explosive scaling. Platforms automate delta-neutral adjustments, harvesting premiums weekly while RWAs accrue value quietly.

Creative edge: Layer in governance tokens for fee shares, amplifying returns subtly. This pragmatic path suits passive seekers, echoing my mantra that puts insure bold pursuits, but covered calls with RE collateral deliver the premiums upfront.

Tokenization’s convergence, as Aurpay dubs it, reshapes DeFi into sustainable machinery. Finviz industries watch real estate pioneer, powering vaults that reward patience over FOMO. Position now in these strategies, and watch your portfolio thrive amid 2026’s RWA boom.