RWA Collateralized Covered Calls in DeFi Vaults: Secure 20%+ APY Strategies

In today’s DeFi landscape, where Ethereum trades at $2,000.75 after a 3.91% dip over the past 24 hours, investors crave strategies that deliver stability alongside outsized returns. RWA collateralized covered calls in DeFi vaults stand out, routinely securing 20% and APY by pairing tokenized real-world assets with options income. This approach sidesteps crypto’s wild swings, anchoring yields to assets like U. S. Treasuries and private credit. As a CFA with deep roots in asset tokenization, I see these vaults as the strategic pivot for yield-hungry portfolios seeking long-term resilience.

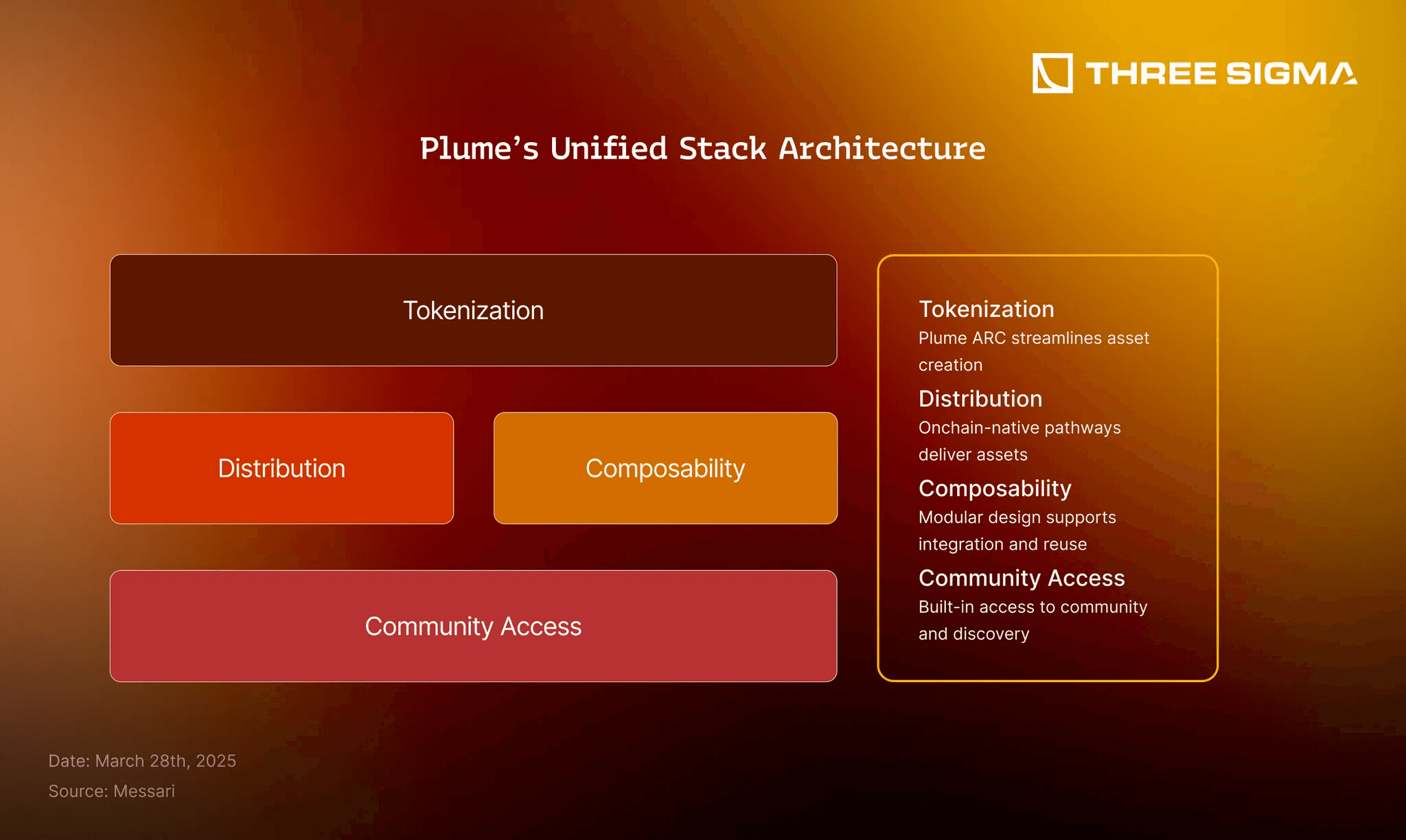

Covered calls work simply: hold an asset long, sell call options against it, and pocket premiums. When collateralized by RWAs, the foundation strengthens. Tokenized T-Bills or real estate notes provide low-volatility backing, turning what could be speculative plays into conservative income machines. Platforms drawing from Centrifuge and Maple Finance tokenization tech enable this, blending TradFi ballast with DeFi automation. Yields hit 20-30% APY in optimized vaults, far eclipsing standard lending pools stuck at single digits.

Tokenized US Treasury Covered Calls: The Stability Anchor

Leading the pack is the Tokenized US Treasury Covered Calls Vault, targeting 20-25% APY through weekly calls on RWA-backed T-Bills. These vaults, spotlighted on DeFiOptionsVaults. com, thrive on ultra-low volatility; T-Bills rarely budge, letting premiums compound without forced sales. In a market where Bitcoin holds at $68,805.00 despite a 1.23% 24-hour slide, this strategy shines for its predictability. Conservative by design, it suits investors prioritizing capital preservation over moonshots, delivering yields that buffer against ETH’s intraday lows of $1,997.35.

Private Credit and Real Estate: Yield Boosters with RWA Depth

Next, Private Credit RWA Collateralized Covered Calls generate 18-22% APY on tokenized loans, automating monthly calls to outpace plain DeFi lending. These draw from real invoices and business credit, tokenized via protocols like Centrifuge, offering 8-12% base yields plus options uplift. Pair this with the Real Estate Tokenized RWA Covered Calls Strategy at 22% and APY; commercial properties as collateral enable quarterly calls in risk-managed setups. Real estate RWAs add diversification, their steady appreciation capping downside while premiums flow.

These aren’t hypotheticals; they’re live strategies crushing traditional yields. Bitcoin’s resilience at $68,805.00 underscores why RWAs matter; crypto collateral alone amplifies losses in downturns, but T-Bills or credit notes hold firm.

Diversified Baskets and Emerging Debt: Scaling the Yield Curve

For broader exposure, the Multi-RWA Basket Covered Calls Vault blends treasuries, credit, and commodities for 20-24% APY, using dynamic strike optimization to adapt to volatility. This mitigates single-asset risks, much like institutional portfolios. Aggressive players eye High-Yield Emerging Market Debt RWA Covered Calls, chasing 25% and APY on tokenized EM debt with hedged calls. Hedging tempers default risks, making it viable for strategic allocation.

Ethereum (ETH) Price Prediction 2027-2032

Forecasts amid RWA collateralized covered calls adoption in DeFi vaults, starting from $2,000.75 baseline in 2026

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from Prev) |

|---|---|---|---|---|

| 2027 | $2,200 | $3,500 | +75% | |

| 2028 | $3,000 | $5,500 | +57% | |

| 2029 | $4,000 | $7,500 | +36% | |

| 2030 | $5,500 | $10,000 | +33% | |

| 2031 | $7,000 | $13,000 | +30% | |

| 2032 | $9,000 | $16,500 | +27% |

Price Prediction Summary

ETH is poised for steady growth driven by RWA-DeFi integration, with average prices potentially reaching $16,500 by 2032 in bullish scenarios, reflecting enhanced yields, adoption, and market cycles. Min/Max account for bearish corrections and bull runs.

Key Factors Affecting Ethereum Price

- RWA tokenization boosting DeFi vault yields (20%+ APY) and ETH utility

- Ethereum network upgrades improving scalability and security

- Regulatory clarity on RWAs and DeFi enhancing institutional inflows

- Market cycles with post-2026 bull phase amid BTC/ETH correlation

- Competition from L2s offset by ETH’s dominance in DeFi TVL

- Macro factors: interest rates, global adoption of tokenized assets

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

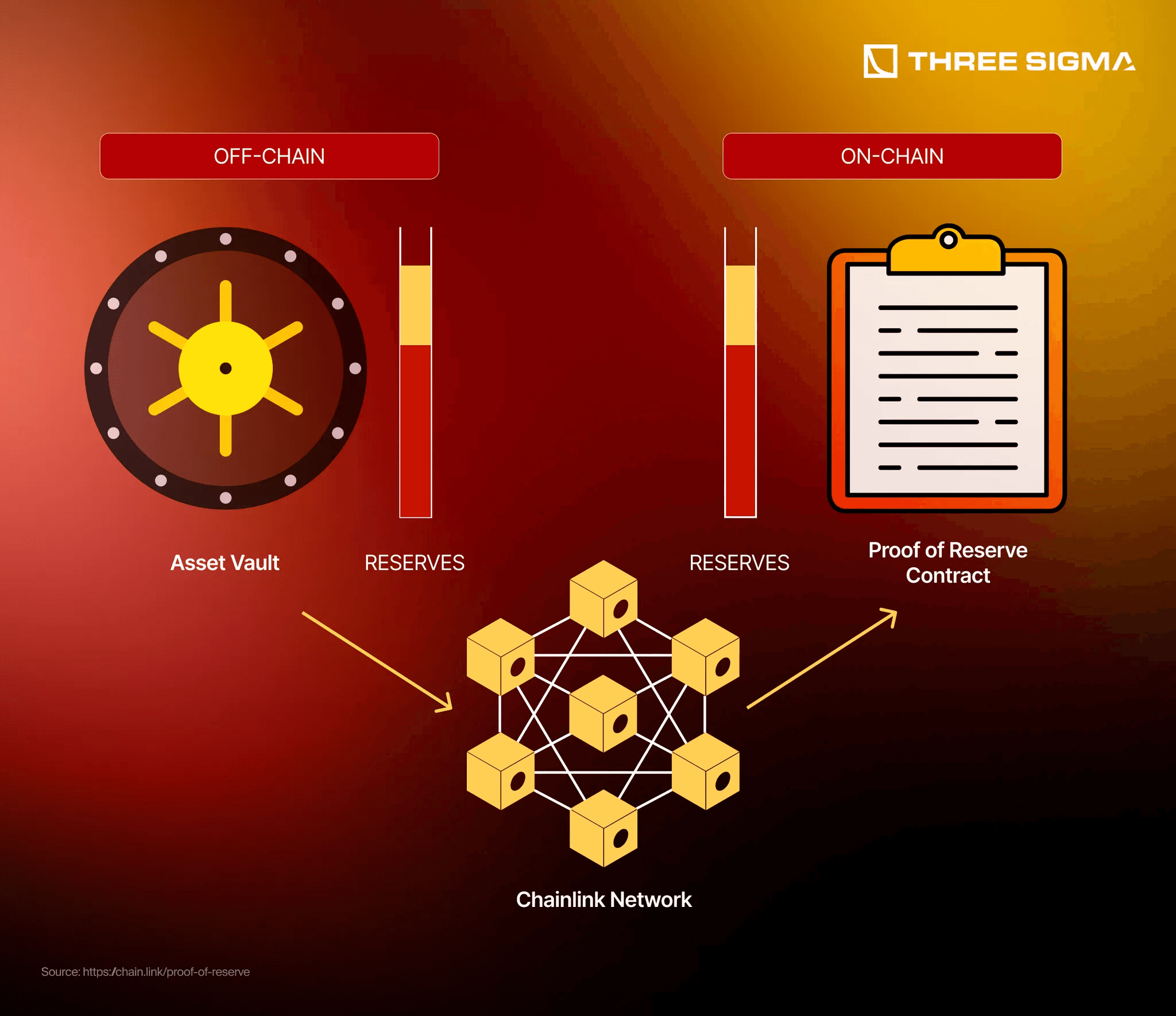

Structurally, these vaults separate accounting from trading; the vault custodians funds, while strategies execute covered calls via smart contracts. Gauntlet-like leverage tweaks amplify efficiency, borrowing stables against RWAs to stack positions. Yet, risks persist: capped upside if assets rally past strikes, plus smart contract and oracle dependencies. RWAs dull these edges, their tangible backing fostering trust over pure crypto bets.

Market context reinforces the timing. With ETH’s 24-hour high at $2,096.75 now behind us, stability trumps speculation. These top five strategies, ranked by stability and yield from DeFiOptionsVaults. com data, position portfolios for sustained outperformance.

Top 5 RWA Covered Calls Strategies

-

Tokenized US Treasury Covered Calls Vault: Secure 20-25% APY by selling weekly covered calls on RWA-backed T-Bills via DeFiOptionsVaults.com for low-volatility yields. Top stability from government-backed assets minimizes risk while generating premium income.

-

Private Credit RWA Collateralized Covered Calls: Generate 18-22% APY on tokenized private credit loans with automated monthly calls, outperforming traditional DeFi lending. Balanced stability via diversified credit pools like Centrifuge.

-

Real Estate Tokenized RWA Covered Calls Strategy: Earn 22%+ APY using commercial real estate RWAs as collateral for quarterly covered calls in risk-managed vaults. Income stability from rental yields plus option premiums.

-

Multi-RWA Basket Covered Calls Vault: Diversify across treasuries, credit, and commodities RWAs for balanced 20-24% APY with dynamic strike optimization. Optimal diversification reduces single-asset volatility.

-

High-Yield Emerging Market Debt RWA Covered Calls: Target 25%+ APY on tokenized EM debt RWAs with hedged covered calls for aggressive yield seekers. Highest yield potential with hedged volatility exposure.

These strategies aren’t just theoretical constructs; they’re battle-tested in live DeFi environments, where protocols like those on DeFiOptionsVaults. com automate execution for precision. Consider the mechanics: vaults deposit RWAs, harvest base yields from underlying assets, then layer covered calls atop. Weekly rotations on treasuries minimize exposure gaps, while quarterly real estate plays capture appreciation cycles. In ETH’s current range-bound action, from $1,997.35 lows to $2,096.75 highs, this theta decay from options premiums proves invaluable, stacking income regardless of direction.

Top 5 RWA Collateralized Covered Calls Strategies Comparison

| Strategy | APY Range | Collateral Type | Call Frequency | Stability (Low/Med/High) | Ideal Investor |

|---|---|---|---|---|---|

| Tokenized US Treasury Covered Calls Vault | 20-25% | RWA-backed T-Bills | Weekly | High | Conservative investors 🐢🛡️ |

| Private Credit RWA Collateralized Covered Calls | 18-22% | Tokenized private credit loans | Monthly | High | Balanced investors ⚖️🏦 |

| Real Estate Tokenized RWA Covered Calls Strategy | 22%+ | Commercial real estate RWAs | Quarterly | Med | Income-focused investors 🏠📈 |

| Multi-RWA Basket Covered Calls Vault | 20-24% | Treasuries, credit, commodities RWAs | Dynamic | High | Diversified investors 🌍🌈 |

| High-Yield Emerging Market Debt RWA Covered Calls | 25%+ | Tokenized EM debt RWAs | Hedged (Monthly) | Low | Aggressive yield seekers 🚀🔥 |

Stability rankings prioritize low-volatility anchors like T-Bills first, escalating to EM debt’s higher-reward profile. The Multi-RWA Basket strikes a shrewd balance, dynamically adjusting strikes via oracles to capture optimal premiums without overcommitting. I’ve advised institutions on similar tokenization plays; the key is collateral quality. Tokenized private credit from vetted invoices outperforms unbacked crypto lending, especially as Bitcoin stabilizes at $68,805.00 amid broader market caution.

Navigating Risks StrategicallyPreservation in Volatile Times

Capped upside defines covered calls; a T-Bill vault sells at strike if rates plunge, forfeiting principal gains. Yet RWAs temper this: their intrinsic value, backed by cash flows or liens, rarely craters like altcoins. Smart contract audits and time-tested protocols mitigate exploits, while diversification across the top five curbs concentration. For aggressive tilts, EM debt’s hedges via puts or collars add layers, targeting 25% and APY without reckless leverage. In my 16 years tokenizing assets, RWAs emerge as the unassailable core, turning DeFi’s chaos into compounded certainty.

Outperformance metrics tell the tale. Traditional USDC lending idles at 5-8% APY; these vaults double or triple that via options alpha. Private credit baselines at 8-12%, uplifted 10 points by calls. Real estate RWAs, with 22% and targets, leverage property betas for equity-like returns minus daily noise. As ETH lingers near $2,000.75, down 3.91% daily, such strategies shine, converting stagnation into streams.

Implementation demands strategy. Start conservative with Tokenized US Treasury vaults for onboarding, scaling into baskets as conviction builds. Vaults handle rebalancing, but monitor implied volatility; elevated IV juices premiums, ideal for entry. Gauntlet-inspired levers borrow conservatively against RWAs, amplifying without fragility. Protocols evolve, incorporating offchain strategies like Injective’s basis trades for hybrid yields.

Ethereum’s footing at $2,000.75 signals a pivot point; yields here endure dips, rewarding patience. Bitcoin’s $68,805.00 hold mirrors this resilience. For yield seekers, these RWA-backed covered calls redefine DeFi vaults, forging paths to 20% and APY with bedrock security. Position accordingly, and watch portfolios fortify against whatever crypto throws next.

6-Month Price Performance: Ethereum vs Key Cryptocurrencies

Bear market declines highlight volatility risks for DeFi vaults, emphasizing RWA collateral stability for 20%+ APY covered call strategies

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| Ethereum | $1,998.94 | $4,251.00 | -53.0% |

| Bitcoin | $68,847.00 | $100,233.44 | -31.3% |

| Solana | $86.97 | $215.00 | -59.5% |

| Chainlink | $8.82 | $13.29 | -33.6% |

| Aave | $126.20 | $266.71 | -52.7% |

| Uniswap | $3.49 | $7.20 | -51.5% |

| Maker | $1,569.52 | $2,009.47 | -21.9% |

Analysis Summary

Over the past six months, major cryptocurrencies have declined amid a bearish market, with Solana dropping 59.5% and Maker holding up best at -21.9%. Ethereum’s 53% decline underscores volatility in DeFi ecosystems, making RWA-collateralized covered calls attractive for stable 20%+ APY yields.

Key Insights

- All assets down over 20%, reflecting broad market downturn

- Maker (MKR) most resilient at -21.9% decline

- Solana (SOL) worst performer at -59.5%

- Ethereum (ETH) and DeFi tokens (AAVE, UNI) clustered around -50-53% drops

- Bitcoin (BTC) outperformed altcoins with -31.3% change

- Highlights RWA collateral’s role in buffering volatility for vault strategies

Data from real-time sources as of 2026-02-15: ETH (calebandbrown.com), BTC (tdmm.io), SOL (cryptorank.io), LINK/AAVE/UNI/MKR (independentreserve.com). 6-month changes calculated from provided historical prices.

Data Sources:

- Main Asset: https://calebandbrown.com/blog/weekly-rollup-august-19-2025/

- Bitcoin: https://tdmm.io/insights/wp-content/uploads/2024/12/TDMM-Weekly-Market-Overview.pdf

- Solana: https://cryptorank.io/insights/reports/crypto-market-recap-august-2025

- Chainlink: https://www.independentreserve.com/eofy

- Aave: https://www.independentreserve.com/eofy

- Uniswap: https://www.independentreserve.com/eofy

- Maker: https://www.independentreserve.com/eofy

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.