RWA Collateralized Covered Calls in DeFi Vaults: Maximize Yields with Stable Asset Backing

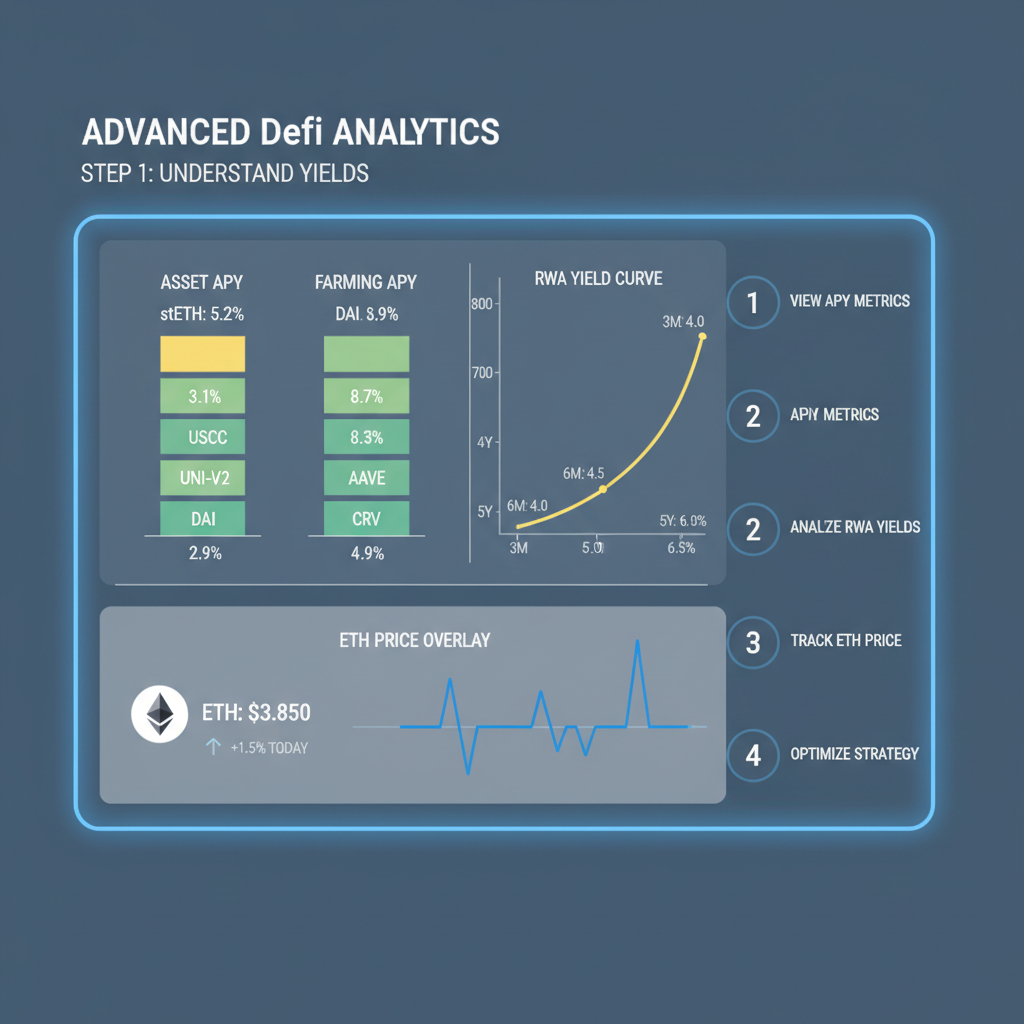

In the evolving landscape of decentralized finance, RWA collateral covered calls emerge as a sophisticated strategy for yield optimization, particularly as Ethereum holds steady at $2,000.56 amid a 24-hour gain of and $30.86. This setup leverages tokenized real-world assets like U. S. Treasury bills to back DeFi options vaults, delivering baseline stability while overlaying high-income covered call premiums. Platforms such as those at DeFiOptionsVaults. com showcase vaults yielding 8-15% on tokenized private credit, outpacing traditional staking amid 2026’s institutional influx.

Tokenized RWAs now represent $20.7 billion on-chain, with $8-9 billion in Treasuries alone, per recent snapshots. This collateral infusion mitigates crypto volatility, allowing vaults to generate consistent returns even as ETH fluctuates between its 24-hour low of $1,945.64 and high of $2,005.27. Investors benefit from automated strategies that sell calls against RWA-secured positions, capturing theta decay without full exposure to underlying price swings.

Mechanics of RWA Collateral in Covered Call Vaults

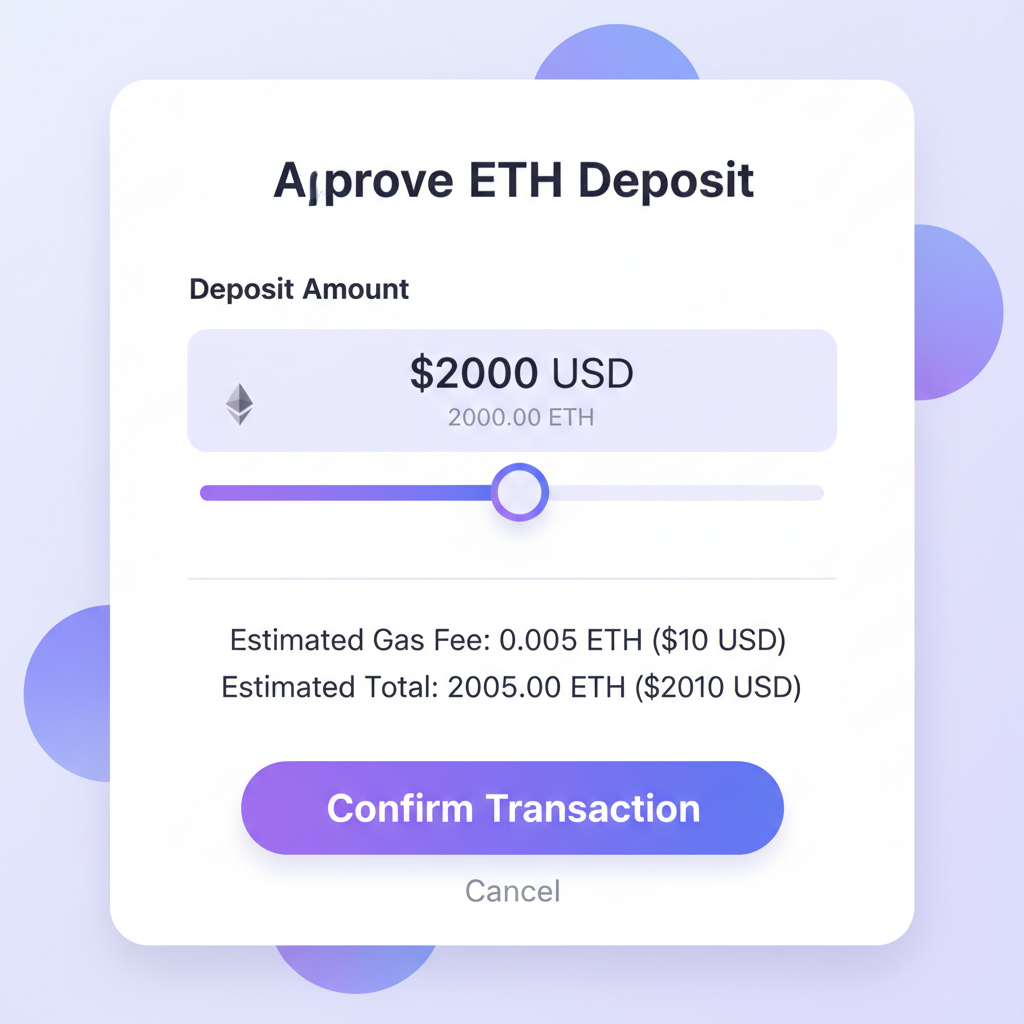

Covered calls in DeFi vaults function by holding a long position in an asset, here collateralized by RWAs, and selling call options against it. The RWA backing, often ERC-4626 compliant vaults like BlackRock’s BUIDL yielding 4.5% APY, provides a low-volatility foundation. For every $1,000 deposited, a portion allocates to T-bills earning baseline yield, while the remainder funds ETH-linked calls. Premiums from sold calls compound atop this, targeting 15-25% APY in bullish consolidations.

Precision entry points rely on technical patterns. At ETH’s current $2,000.56 level, vaults assess implied volatility; elevated IV post-24-hour range expansion signals rich premiums. Risk management caps upside via strikes 10-20% out-of-the-money, ensuring collateral retention unless ETH surges beyond thresholds. This hybrid buffers downturns: during 2025 consolidations, similar setups delivered 20% and APY, surpassing pure ETH staking.

Superior Yields from RWA-Backed DeFi Options Vaults

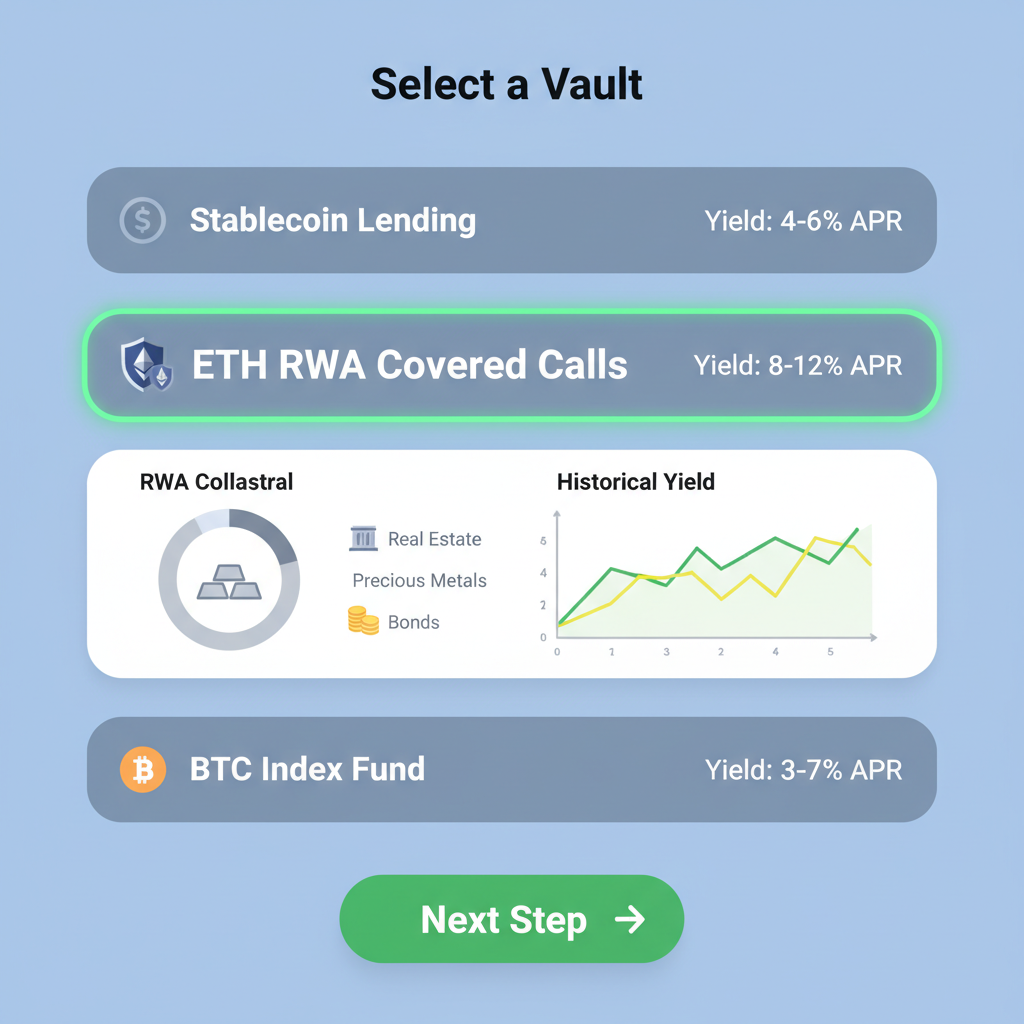

DeFi options vaults RWAs crush legacy yields by blending stablecoin-like security with options leverage. Galaxy’s onchain yield guide highlights RWAs as a top tier, with lending and vaults posting 15% and amid stablecoin baselines of 4-6%. dForce’s 2026 ecosystem, anchored by USX and RWA lanes, exemplifies this capital stack, where covered calls amplify returns on tokenized credit.

Quantitative edge: assume $10,000 vault deposit with 50% RWA allocation at 4.5% APY ($225 annual). Overlay covered calls at 1% monthly premium ($1,200 yearly), netting 14.25% pre-fees. Adjust for ETH at $2,000.56; delta-neutral positioning via dynamic strikes maintains neutrality. Projections to 2030 see RWA markets at $9.4-18.9 trillion, fueling DeFi’s yield supercycle as institutions adopt MiCA-compliant interfaces.

| Vault Type | Collateral | Baseline APY | Call Overlay | Total Target |

|---|---|---|---|---|

| Covered Calls | RWA T-Bills | 4.5% | 10-20% | 15-25% |

| ETH Staking | Pure ETH | 3-5% | N/A | 3-5% |

| Lending | Stablecoins | 4-6% | N/A | 4-6% |

Institutional Momentum and ETH Integration at Current Levels

Zodia Custody predicts DeFi as 2026’s core yield rail for institutions, powered by RWA collateral models. TermMax’s tokenized stocks enable covered calls with physical delivery, bridging TradFi. At ETH $2,000.56, vaults interface via CEXs, onboarding wallet-free users. This frictionless access, paired with defined-outcome overlays akin to UCITS wrappers, positions covered calls real world assets as gateways.

Charts reveal potential: ETH’s 0.0157% 24-hour uptick signals stability for call writing. Support at $1,945.64 low holds, with resistance near $2,005.27 high. Vault algorithms exploit this range, rolling calls weekly to harvest premiums. DeFi Dad’s insights underscore vaults scaling to millions, while Crypto Briefing flags 2026 infrastructure readiness.

Ethereum (ETH) Price Prediction 2027-2032

Forecasts in the context of RWA Collateralized Covered Calls in DeFi Vaults | Baseline: $2,000 (Early 2026)

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) | YoY Change % (Avg from Prior Year) |

|---|---|---|---|---|

| 2027 | $2,800 | $4,200 | $6,500 | +68% |

| 2028 | $3,500 | $6,800 | $11,000 | +62% |

| 2029 | $4,200 | $9,500 | $16,000 | +40% |

| 2030 | $5,000 | $12,500 | $22,000 | +32% |

| 2031 | $6,000 | $16,000 | $28,000 | +28% |

| 2032 | $7,500 | $20,000 | $35,000 | +25% |

Price Prediction Summary

ETH is forecasted to experience robust growth from 2027-2032, propelled by RWA integration in DeFi vaults yielding 15-25% APYs, institutional adoption, and market cycles. Average prices could rise from $4,200 in 2027 to $20,000 by 2032, with min/max reflecting bearish corrections and bullish peaks.

Key Factors Affecting Ethereum Price

- RWA tokenization boom on Ethereum driving trillions in TVL

- High-yield covered calls in DeFi vaults buffering ETH volatility

- Institutional inflows via walletless access and MiCA-compliant products

- Ethereum upgrades enhancing scalability and L2 efficiency

- Positive regulatory tailwinds and crypto market bull cycles

- Competition managed by ETH’s DeFi dominance and network effects

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

While the allure of 15-25% APY draws yield hunters, prudent risk assessment anchors long-term success in RWA backed options strategies. Smart contract vulnerabilities top the list, though audited ERC-4626 vaults like those tokenized by BlackRock minimize exploits. RWA issuer credit risk looms if private credit underperforms, yet diversified T-bill allocations cap exposure at 20-30% of principal. Opportunity cost bites during ETH rallies beyond strike prices; at $2,000.56, a 20% OTM call forfeits upside above $2,400.72, but theta capture offsets this in range-bound markets.

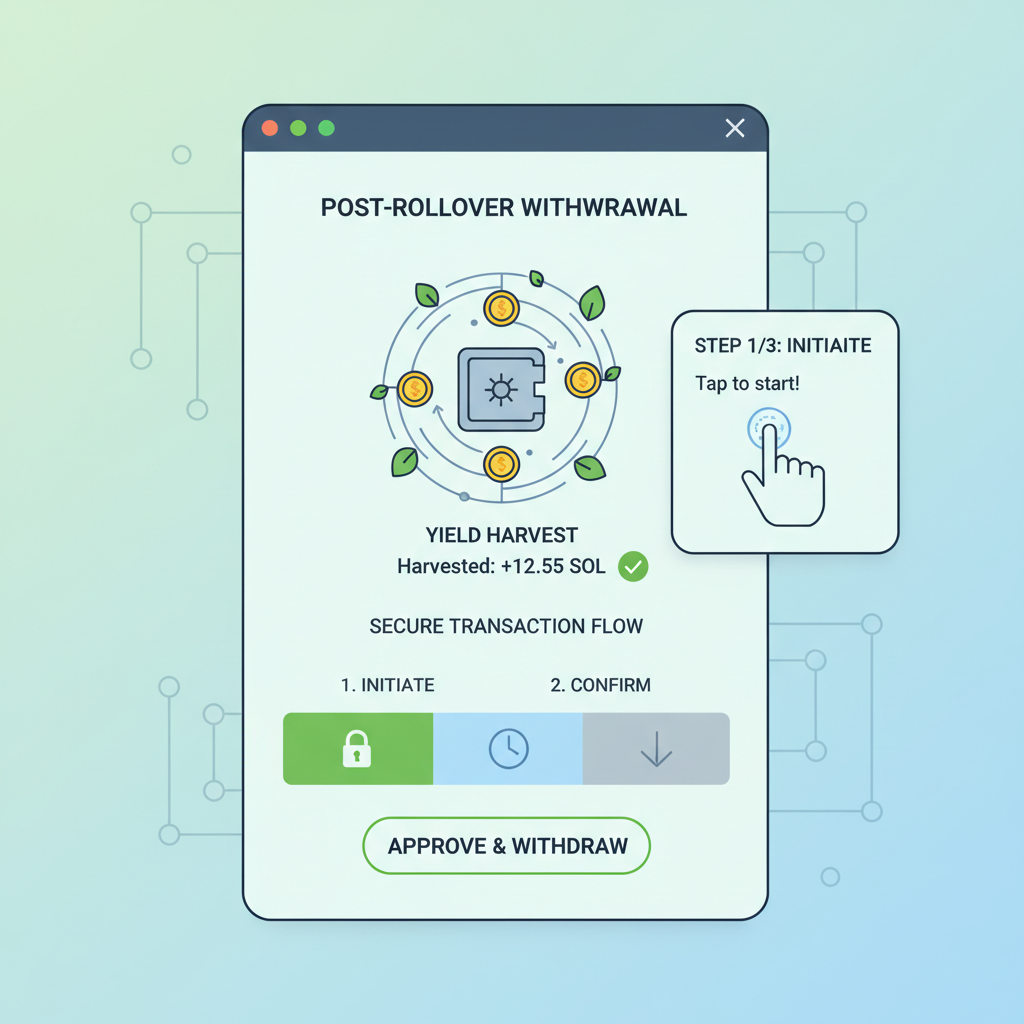

Balancing Calls with Covered Puts for Yield Symmetry

DeFi vaults covered puts yields offer a bearish counterpart, selling puts against RWA collateral to collect premiums while retaining obligation to buy at strikes. Ideal when ETH tests support at $1,945.64, this flips the script: vaults earn from premium decay if prices hold, with RWAs buffering assignment risk. Hybrid vaults alternate strategies dynamically; bullish bias favors calls, while 0.0157% daily gains signal continuation. Quantitative models project 12-18% APY on puts, complementing calls for all-weather portfolios. In 2026’s institutional pivot, Zodia’s forecast of DeFi as collateral rails amplifies this duality.

Ondo Finance Technical Analysis Chart

Analysis by Market Analyst | Symbol: BINANCE:ONDOUSDT | Interval: 1D | Drawings: 7

Technical Analysis Summary

As a balanced technical analyst with 5 years experience specializing in technical analysis, start by drawing a primary downtrend line connecting the swing high at approximately 1.05 on 2026-10-15 to the recent swing low at 0.62 on 2026-02-10, using ‘trend_line’ tool. Add horizontal support lines at 0.62 (strong), 0.70 (moderate), and resistance at 0.78 (moderate), 0.92 (strong) with ‘horizontal_line’. Mark the sharp breakdown from consolidation using ‘vertical_line’ around 2026-01-20. Use ‘fib_retracement’ from the Oct high 1.05 to Feb low 0.62, highlighting 38.2% retracement at ~0.78 and 50% at ~0.835. For entry/exit, draw ‘long_position’ zone near 0.62-0.65 support, profit target at 0.78 with ‘order_line’, stop loss below 0.60. Add ‘callout’ for volume spike on breakdown indicating distribution, and ‘arrow_mark_down’ for bearish MACD crossover mid-January. Finally, rectangle the late-Dec to early-Jan consolidation range 0.75-0.85.

Risk Assessment: medium

Analysis: Bearish trend intact but oversold conditions and RWA fundamentals suggest bounce potential; medium tolerance favors defined risk entries

Market Analyst’s Recommendation: Consider long on confirmation above 0.68 with stop below 0.60, targeting 0.78; monitor ETH at $2,000 for correlation

Key Support & Resistance Levels

📈 Support Levels:

-

$0.62 – Recent swing low with volume exhaustion, aligns with 100% Fib extension

strong -

$0.7 – Prior consolidation low from Jan, moderate volume support

moderate

📉 Resistance Levels:

-

$0.78 – 38.2% Fib retracement and prior swing high from early Feb

moderate -

$0.92 – Strong horizontal resistance from Nov-Dec highs

strong

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$0.64 – Bounce from strong support at 0.62 with potential bullish divergence, aligned with RWA yield narrative

medium risk

🚪 Exit Zones:

-

$0.78 – 38.2% Fib target and resistance confluence

💰 profit target -

$0.58 – Below recent low to invalidate bounce

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: spike on downside break, then declining

High volume confirms January breakdown as distribution, low volume on recent bounce suggests weakness continuation

📈 MACD Analysis:

Signal: bearish crossover

MACD line crossed below signal in mid-Jan, histogram negative, no divergence yet

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Market Analyst is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

TermMax’s tokenized equities extend this to stocks, where physical delivery secures covered strategies. Galaxy’s yield report pegs RWA vaults ahead of restaking, with $20.7B on-chain RWAs signaling momentum. dForce’s USX stack integrates lending atop RWAs, yet options overlays claim the premium tier. At ETH’s $2,000.56 perch, low 24-hour volatility post-$1,945.64 support favors premium-rich environments.

Deploying Capital: Precision Execution

Chart patterns dictate entries; ETH’s consolidation near $2,005.27 resistance screams call-writing opportunity. Bollinger Bands contracting around $2,000.56 forecast IV crush, juicing premiums. My read: vaults thrive here, as 2025’s 20% and deliveries prove. Institutions bypass wallets via CEX bridges, MiCA compliance greasing rails for $376B represented assets.

| Risk Factor | Impact | Mitigation | RWA Buffer |

|---|---|---|---|

| Smart Contract | High | Multi-audits | Off-chain T-bills |

| Volatility | Medium | OTM strikes | 4.5% baseline |

| Assignment | Low | Dynamic rolls | Collateral retention |

| Credit (RWA) | Medium | Diversification | Govt securities |

John Zettler’s vault prophecy rings true: 2026 infrastructure matures, RWAs to $9.4 trillion by 2030. BlackRock’s BUIDL at 4.5% anchors overlays crushing 3-5% staking. Smart money rotates here, harvesting theta amid ETH’s steady $2,000.56 grind. Passive seekers, active traders alike find asymmetry; charts confirm the edge. As DeFi vaults scale, covered calls real world assets redefine yield paradigms, blending TradFi ballast with crypto alpha for portfolios built to endure.

Ethereum Technical Analysis Chart

Analysis by Market Analyst | Symbol: BINANCE:ETHUSDT | Interval: 1D | Drawings: 5

Technical Analysis Summary

As a seasoned technical analyst with a balanced approach, I recommend the following drawing instructions to annotate this ETHUSDT chart effectively: 1. Draw a prominent downtrend line connecting the October 2026 high around $4,500 to the late January 2027 low near $1,950, using ‘trend_line’ tool with red color for bearish bias. 2. Add horizontal support at $1,945 (24h low) and resistance at $2,005 (24h high), marked as strong levels with labels. 3. Use ‘rectangle’ for the recent consolidation zone from early February 2027 between $1,900-$2,050. 4. Place ‘arrow_mark_down’ at the December 2026 breakdown below $3,000. 5. ‘horizontal_line’ for key supports at $1,900 and $2,200. 6. ‘callout’ for volume spikes on downside confirming bearish pressure. 7. ‘text’ boxes for MACD bearish divergence notes. This setup highlights the dominant downtrend while flagging potential reversal zones near current $2,000.56 price.

Risk Assessment: medium

Analysis: Dominant downtrend but nearing strong support at $1,945 with current price $2,000.56; RWA yield narratives provide tailwind but technicals bearish

Market Analyst’s Recommendation: Hold off on longs until $2,005 break or $1,945 hold with volume; consider shorts on failed bounce, aligned to medium risk tolerance

Key Support & Resistance Levels

📈 Support Levels:

-

$1,945.64 – Recent 24h low and chart bottom, strong volume support

strong -

$1,900 – Psychological and prior swing low

moderate

📉 Resistance Levels:

-

$2,005.27 – 24h high, immediate overhead resistance

weak -

$2,200 – Prior consolidation high from January 2027

moderate

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$1,950 – Bounce from strong support at 24h low amid oversold conditions

medium risk -

$2,005 – Break above resistance for bullish confirmation

high risk

🚪 Exit Zones:

-

$2,100 – Initial profit target at next resistance

💰 profit target -

$1,900 – Stop loss below key support

🛡️ stop loss -

$2,250 – Extended target on trend break

💰 profit target

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Bearish divergence – spikes on downside, weak on ups

Volume confirms downtrend strength, low volume on recent bounce signals weakness

📈 MACD Analysis:

Signal: Bearish crossover persisting

MACD below zero with histogram contracting but negative, no bullish divergence

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Market Analyst is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).