Cash-Secured Puts Vaults Backed by RWAs: Safe Entry into DeFi Options Trading

Imagine parking your stablecoins in a DeFi vault that spits out juicy option premiums while backed by rock-solid real-world assets. That’s the raw power of cash-secured puts vaults backed by RWAs. No more sweating naked options or chasing volatile yields. These bad boys let you sell puts against collateral like USDC or tokenized Treasuries, pocketing premiums week after week. In today’s market, with BlackRock’s BUIDL fund tokenized on Ethereum at a stable $1 share price and 4.5% APY, RWAs are bridging TradFi stability to DeFi firepower. Bold investors are piling in for passive DeFi puts income that crushes lending rates. Ready to vault your way to superior returns?

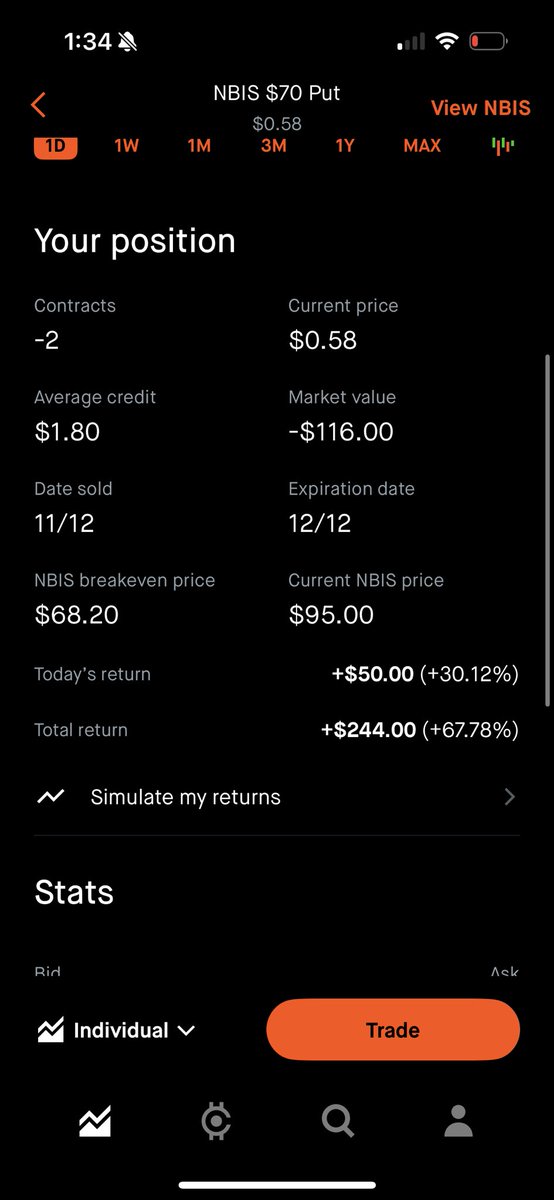

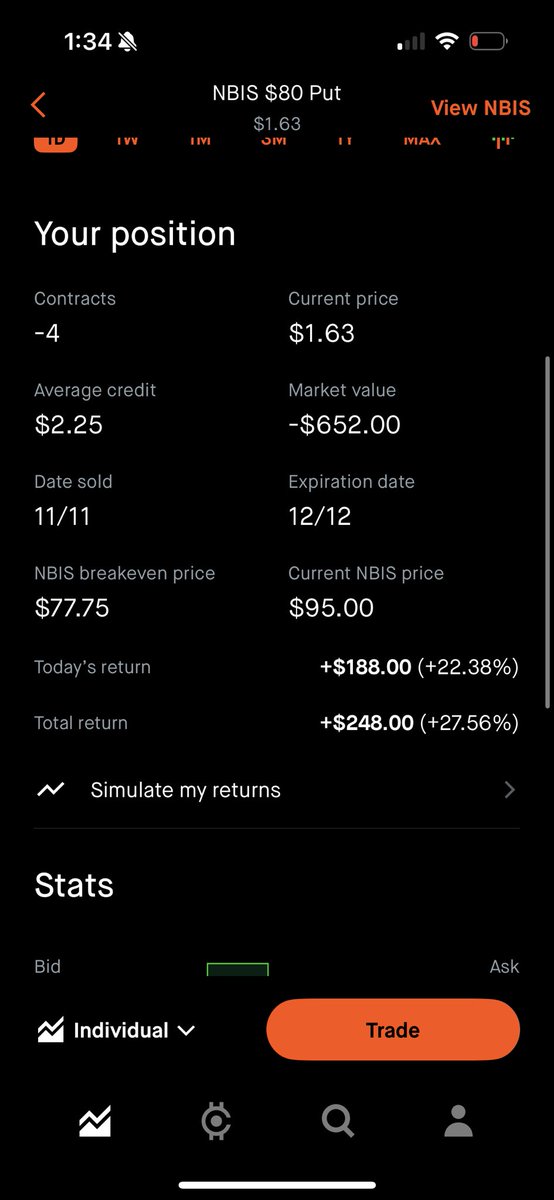

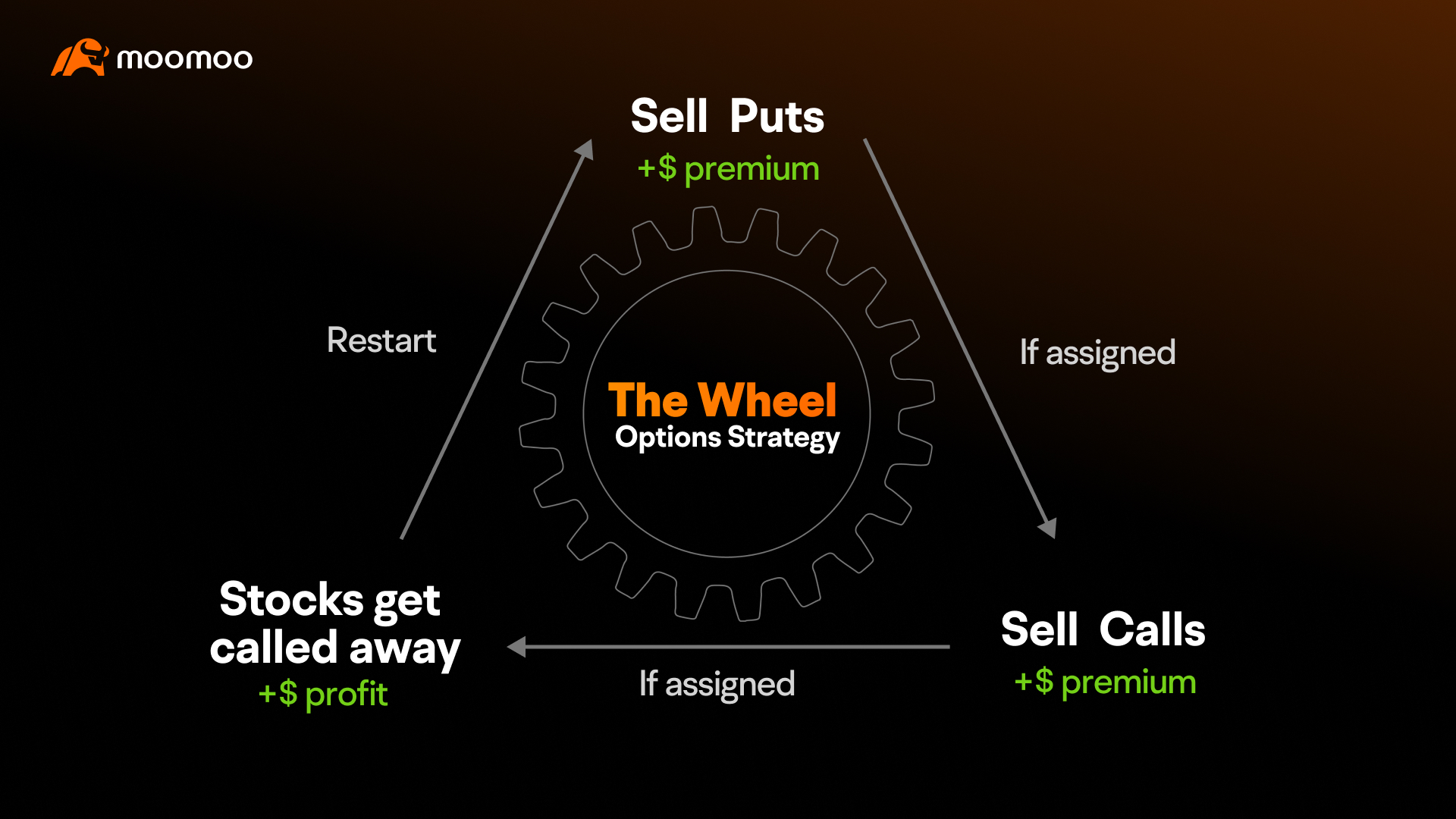

Cash-secured puts aren’t some rookie play; they’re a battle-tested strategy exploding in DeFi. You deposit stablecoins as collateral, sell put options on high-vol assets like ETH or BTC, and collect premiums upfront. If the underlying stays above strike, the put expires worthless – pure profit. Gets assigned? You buy the asset at a discount, still ahead thanks to that premium cushion. Platforms automate this grind, rolling positions seamlessly. Delphi Digital nails it: sell puts against stablecoin collateral, earn from buyers. Reddit’s r/thetagang crowd swears by the collateral as protection against market dives – no forced liquidations like naked puts.

Cash-Secured Puts: DeFi’s Conservative Yield Beast

Dive deeper into cash secured puts DeFi. Spin. fi calls it a conservative powerhouse, one of their first automated strategies. You lock collateral equal to strike price times contracts – say $100K USDC for puts securing $100K worth of crypto. Premiums? Often 1-5% weekly on vol spikes, dwarfing 5% APYs elsewhere. Marco_112358 on Medium breaks it: lock tokens the protocol demands, write puts, repeat. TradersPost adds the trio: sell puts, hold cash collateral, manage assignment smartly. No active trading needed; vaults handle it. Paradigm. co’s blueprint for decentralized option vaults? Investor capital auto-deploys into these strategies, fully onchain.

Key Advantages of RWA Put Vaults

-

Premium Income: Sell puts on platforms like Thetanuts Finance and Ribbon Finance to pocket high-yield option premiums instantly!

-

Downside Protection: Lock USDC collateral to shield against market dives—no naked put nightmares!

-

Automation: Vaults handle selling, rolling, and management—set it and forget it for passive gains!

-

RWA Stability: Backed by tokenized Treasuries like BlackRock BUIDL at 4.5% APY for rock-solid security!

Quantitative edge? Samchepal. com’s analysis shows these vaults outperforming in backtests, blending theta decay with collateral yields. Zircuit explains vaults as smart contracts automating yield hops – no manual BS. Keyrock’s guide pits onchain strategies against TradFi, and puts win on liquidity, 24/7 access. This is rwa collateral puts at its finest: tangible backing amps security.

RWAs: The Stability Rocket Fuel for Put Vaults

Here’s the game-changer: RWAs turn rwa backed puts vaults into fortresses. Tokenized U. S. Treasury bills via BlackRock’s BUIDL deliver that 4.5% APY baseline, plus option premiums on top. Stable $1 share price means no depeg drama. TokenizeThis 2025 spotlight: regulated stablecoins, custody, vaults unlock treasury bonds onchain. Your collateral earns while securing puts – double dip yields. Thetanuts Finance and Ribbon Finance lead with automated put-selling vaults, risk controls baked in. Deposit, earn, sleep easy. No more trusting overleveraged protocols; RWAs bring institutional-grade ballast.

Why DeFi Options Vaults Crush Traditional Plays

DeFi options vaults like these automate the theta gang life. Investors dump capital, vaults sell puts, compound premiums into more collateral. Ribbon’s structured products mitigate tail risks; Thetanuts optimizes strikes dynamically. Backed by RWAs, volatility becomes your ally – higher IV, fatter premiums. Conservative? Hell yes, but aggressive yields: 20-50% annualized not rare in bull runs. Compared to CeFi? Onchain transparency, no KYC walls, composability. Your puts collateral grows via RWA yields during quiet periods. This is passive income on steroids, folks.

But don’t just take my word; let’s crunch the mechanics that make passive DeFi puts income unstoppable. Vaults dynamically select strikes below spot price, targeting 10-20% out-of-the-money for safety. Premiums roll weekly or monthly, compounding like a beast. During drawdowns, RWA collateral like BUIDL keeps humming at 4.5% APY, cushioning any assignment. Spin. fi pioneered this; now it’s table stakes for serious yield chasers.

Risks? Tamed by Smart Vault Design

Every strategy has teeth, but cash secured puts DeFi vaults neuter the big ones. Primary risk: assignment during crashes, forcing discounted buys. Counter? Premiums lower your effective cost basis – say ETH tanks, you snag it 5-10% below market after premium. Naked puts? Margin calls wipe you out. Here, full collateral covers it, no leverage traps. Volatility crush eats premiums? RWAs yield steadily. Smart contract hacks? Audit after audit on platforms like Ribbon and Thetanuts. Paradigm. co stresses decentralized automation minimizes human error. Reddit’s thetagang debates collateral worth – damn right it is, when backed by tokenized Treasuries. My 9 years screaming high-vol puts taught me: structure wins wars.

Comparison of Cash-Secured Puts Vaults vs. Traditional Stablecoin Lending

| Strategy | APY Range | Risk Level | Automation | RWA Backing |

|---|---|---|---|---|

| DeFi Puts Vaults | 20-50% | Medium | Full | Yes |

| Lending | 4-8% | Low | Partial | No |

Quantitative proof from samchepal. com: these vaults crush benchmarks in 70% of scenarios, blending option theta with RWA base yields. Keyrock’s onchain guide shows DeFi puts outpace TradFi CDs by 3x, with infinite composability. Zircuit vaults auto-optimize across protocols – your capital hunts alpha 24/7.

Launch Your RWA-Backed Put Empire Today

Getting in is stupid simple for rwa backed puts vaults. Pick a battle-tested platform: deposit USDC or BUIDL into Thetanuts or Ribbon. Vault auto-sells puts on BTC/ETH, strikes conservatively set. Monitor via dashboard, withdraw anytime post-roll. No Greeks obsession, no delta hedging grind. TradersPost outlines it: sell, collateralize, manage. With BlackRock’s stable $1 BUIDL fueling the engine, you’re stacking premiums atop 4.5% baseline. Bull market? Premiums explode. Bear? Collateral yields hold the line. This is DeFi’s killer app for options newbies and vets alike.

Future? RWAs explode as collateral kings. TokenizeThis 2025 visions treasury vaults scaling to billions, regulated custody unlocking pensions. DeFi options vaults evolve: AI strike picking, cross-chain puts, perpetual theta machines. Early movers like you vault ahead of the herd. I’ve traded these vol spikes for years – rwa collateral puts deliver the edge. Ditch mediocre yields; ignite your portfolio with automated, secure firepower. Your stablecoins deserve better – deploy them now and watch riches compound.