Rolling Covered Calls in RWA-Backed DeFi Vaults: Adjust for Sideways Markets

In the evolving DeFi ecosystem as of February 4,2026, rolling covered calls within RWA-backed vaults stands out as a precise tool for yield optimization during sideways markets. Tokenized real-world assets like U. S. Treasury bills or corporate bonds serve as collateral, providing the stability traditional crypto lacks. This strategy lets investors sell call options against these holdings, pocketing premiums while the underlying price trades in a tight range. Sophisticated players, from institutions to yield seekers, favor it for consistent income without chasing volatility.

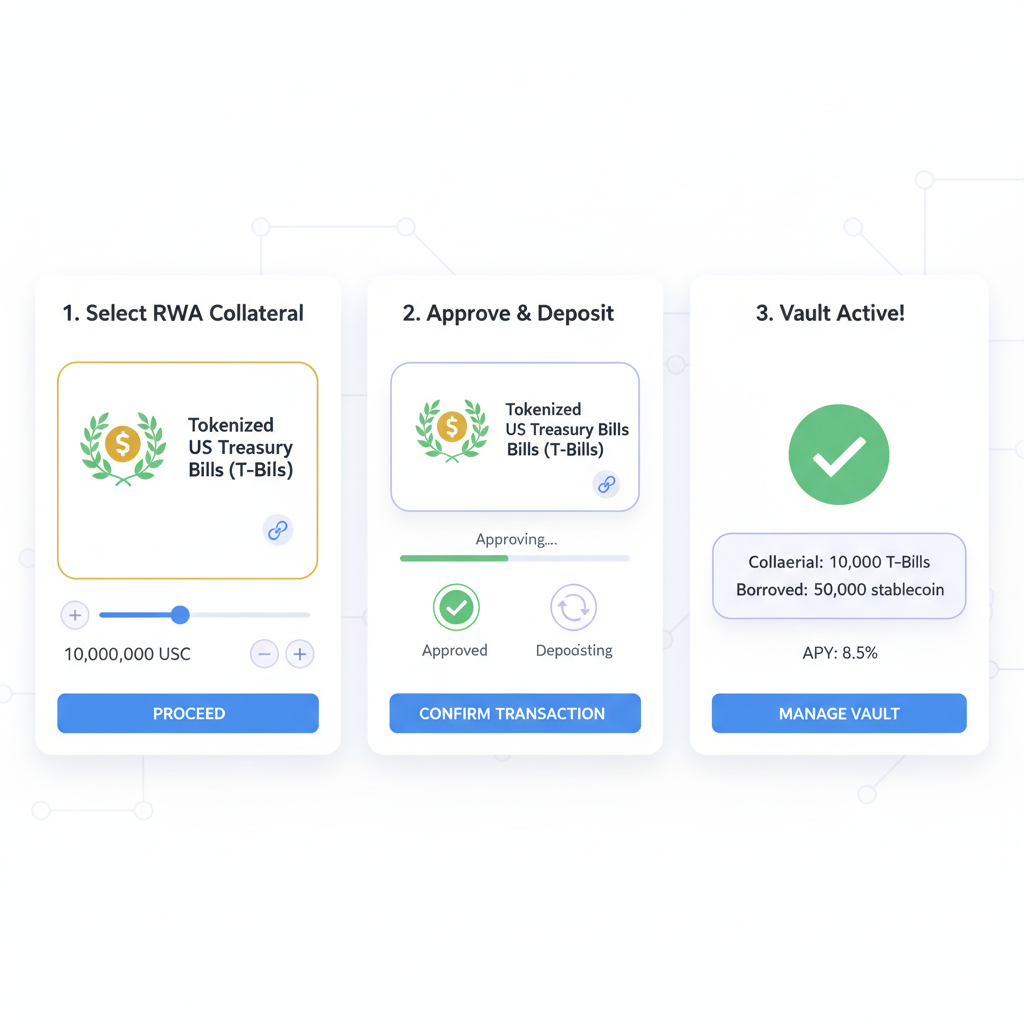

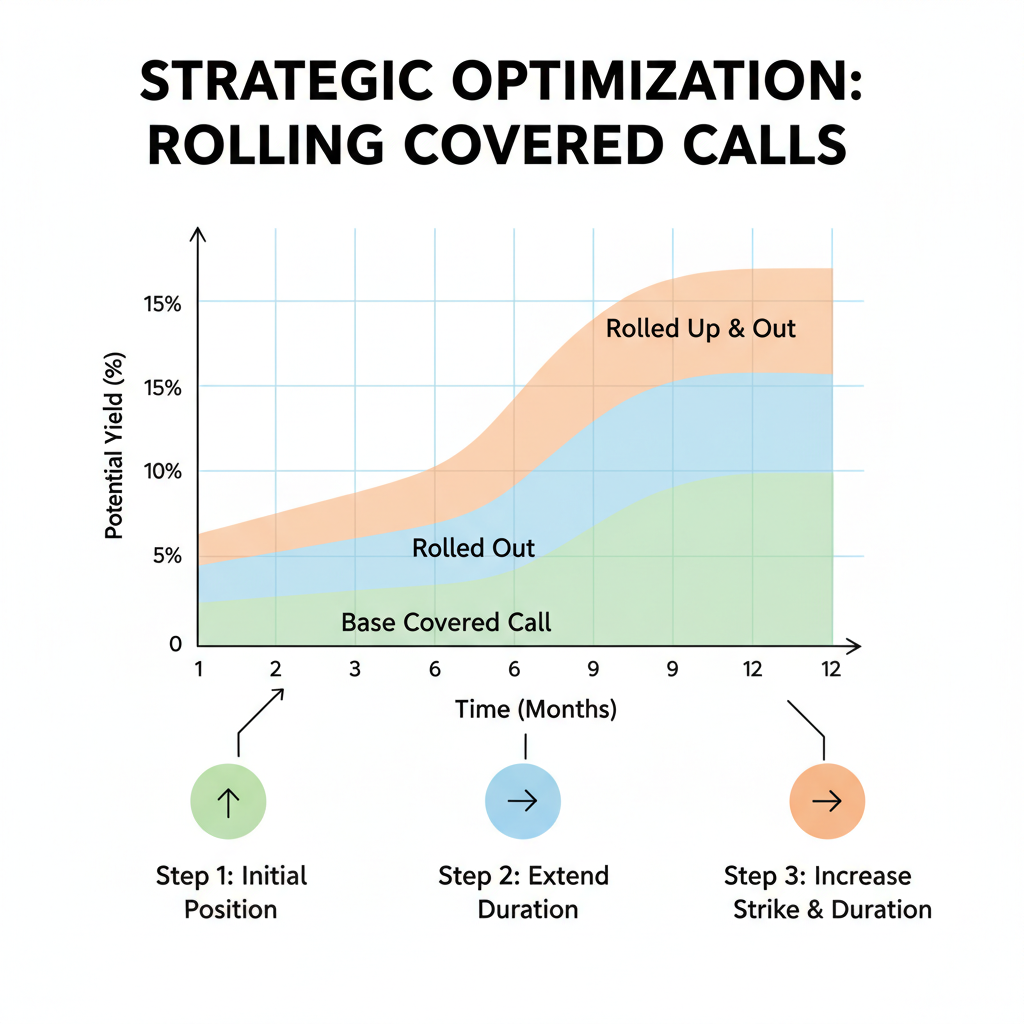

Covered calls involve holding the asset and selling calls on it, capping upside but generating premium income. Rolling extends this: when a call nears expiration or goes in-the-money, you close the position and open a new one, often further out in time or at a higher strike. In DeFi options vaults, automation handles this, reducing manual intervention. Platforms integrate RWAs, blending TradFi security with onchain efficiency, as seen in protocols like Maple Finance’s syrupUSDC, backed by institutional credit.

Mechanics of Rolling in RWA Collateralized Vaults

Picture depositing tokenized T-bills into a vault. The protocol sells calls at strikes above the current price, collecting premiums that boost your yield. In sideways conditions, where prices fluctuate narrowly, these options expire worthless. You keep the premium and asset, then roll: buy back the expiring call and sell a fresh one. This “rolling covered calls DeFi” tactic compounds returns, outpacing basic staking.

Quantitative analyses affirm its edge. Institutions deploy covered calls for steady income, and DeFi vaults automate it seamlessly. Unlike naked calls, RWA collateral mitigates risk; if called away, you retain stable assets. Yet, opinionated take: prioritize vaults with recursive loops, where vault tokens collateralize further deposits on Aave or Morpho, amplifying yields without proportional risk.

Why Sideways Markets Favor RWA Vault Adjustments

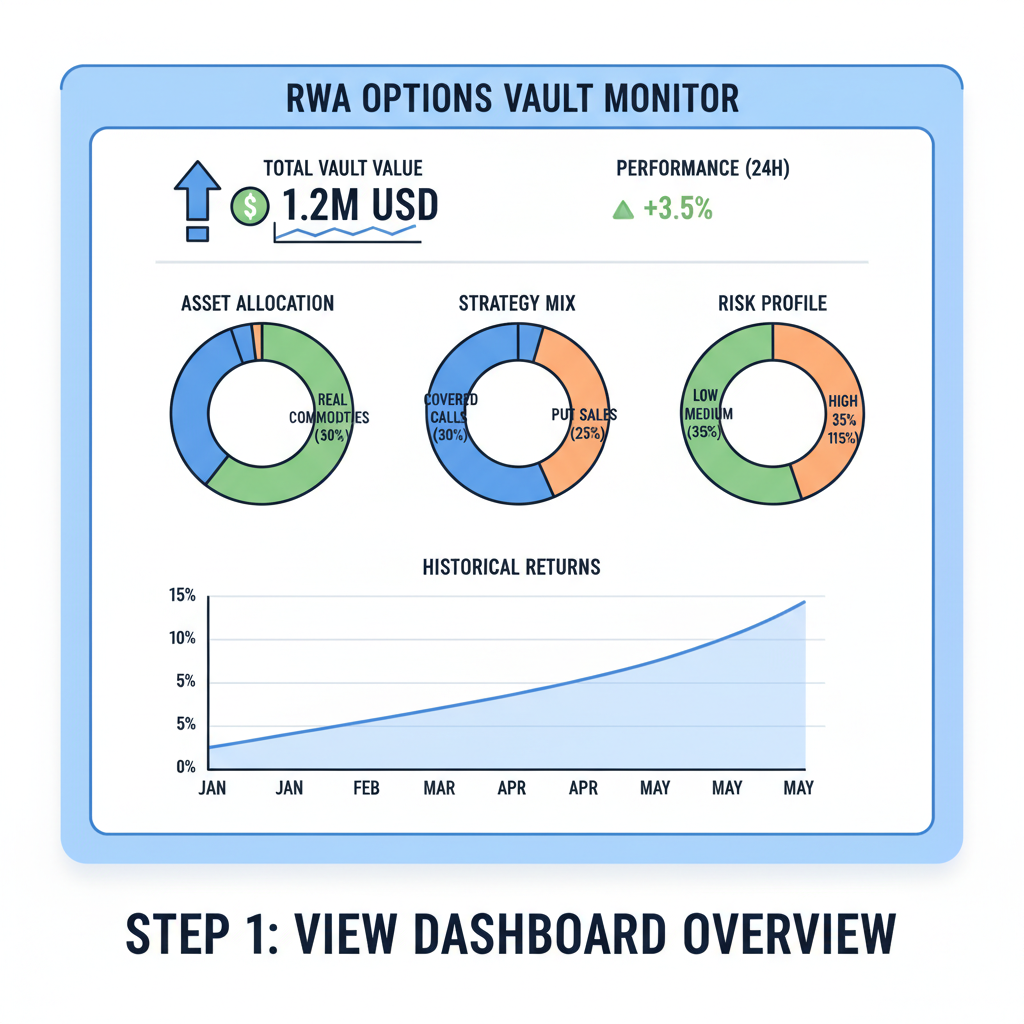

Sideways markets test strategies; pure holding yields little, while directional bets falter. Here, rolling covered calls adjustments RWA shine. Sell out-of-the-money calls, capturing time decay (theta) as prices oscillate. Premiums from narrow ranges add 10-20% annualized yield atop RWA baselines, per recent Ribbon Research on automated options.

RWAs anchor this: their low volatility versus crypto natives like SOL ensures calls stay out-of-the-money longer. In a range-bound Treasury token at stable value, rolling becomes rhythmic income. Risks persist, downside exposure minus premium, or opportunity cost on breakouts. Strategic nuance: roll up and out on strength, down on weakness, maintaining delta neutrality.

DeFi vaults evolve with best practices from Paradigm: covered calls dominate decentralized option vaults (DOVs). Zircuit-style loops deposit, borrow, redeposit, fueling perpetual rolling. My view, forged from 16 years in asset tokenization: RWAs are the bedrock, turning volatile DeFi into conservative powerhouses.

Ondo Finance Technical Analysis Chart

Analysis by Market Analyst | Symbol: BINANCE:ONDOUSDT | Interval: 1D | Drawings: 7

Technical Analysis Summary

As a seasoned technical analyst with a balanced approach, meticulously draw a bold red downtrend line connecting the swing high at approximately 1.12 USDT on 2026-11-20 to the recent low at 0.82 USDT on 2026-02-01, extending it forward to project potential further downside. Add strong horizontal support lines at 0.82 USDT (recent lows) and 0.80 USDT (psychological extension), with moderate resistance at 0.95 USDT and strong at 1.00 USDT. Enclose the late January to early February consolidation in a light blue rectangle from 0.82-0.88 USDT. Place a downward arrow marker at the sharp breakdown candle around 2026-12-25 to highlight volume confirmation. Apply Fibonacci retracement from the November high to February low for bounce levels at 0.38% (0.92 USDT) and 0.50% (0.97 USDT). Add callouts for MACD bearish signal and volume spike. Use vertical line for the breakdown date. These drawings encapsulate the bearish structure while noting sideways potential for strategies like covered calls in RWA DeFi vaults.

Risk Assessment: medium

Analysis: Recent volatility from rally to drop, now sideways consolidation reduces immediate downside but crypto/RWA sector risks persist; medium tolerance suits scaled entries here

Market Analyst’s Recommendation: Hold off aggressive positions; consider long on support bounce with tight stops for yield overlay via DeFi covered calls, or short on trendline break lower. Balanced: 60% bearish bias.

Key Support & Resistance Levels

📈 Support Levels:

-

$0.82 – Cluster of recent swing lows post-breakdown, strong volume base

strong -

$0.8 – Psychological round number and extension of trendline projection

moderate

📉 Resistance Levels:

-

$0.95 – Recent consolidation highs and minor retracement level

moderate -

$1 – Prior support turned resistance from early rally

strong

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$0.83 – Potential bounce from strong support in sideways consolidation, aligned with fib 0.236 retracement

medium risk -

$0.91 – Break and retest of resistance for bullish confirmation

low risk

🚪 Exit Zones:

-

$0.95 – Initial profit target at resistance confluence

💰 profit target -

$0.8 – Stop loss below key support to limit downside

🛡️ stop loss -

$1 – Extended target on resistance break

💰 profit target

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: spike on downside

Elevated volume during December-January breakdown confirms selling pressure, now contracting in consolidation suggesting exhaustion

📈 MACD Analysis:

Signal: bearish below zero line

MACD line crossed below signal with negative histogram expansion on drop, watch for divergence in current lows

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Market Analyst is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

Precision Tactics for Defi Options Rolling Strategies

Mastering DeFi vaults rolling premiums demands discipline. Target 30-45 day expirations for optimal theta decay. Select strikes 5-10% out-of-the-money, balancing premium and safety. Automation in vaults like those from Ribbon or samchepal’s analyses adjusts dynamically, harvesting expired options weekly.

Reddit wisdom from r/CoveredCalls nails it: rolling avoids premium loss by scaling positions. In RWAs, this scales safely; borrow against vault tokens for leverage, but cap at 1.5x to preserve margin. Sideways persistence, as in current 2026 conditions, rewards patience. Track implied volatility; high IV inflates premiums, prime for selling.